The Al Baraka Bank App affords a seamless combination of modern-day banking comfort and Sharia-compliant monetary offerings. Designed to hold you related in your price range on the pass, this app allows you to manipulate debts, switch finances, and perform numerous transactions securely out of your smartphone. With a focus on safety and consumer-friendliness, the Al Baraka Bank App guarantees that your digital banking is as truthful as conventional techniques, making ordinary monetary management effortless and secure.

Features of Al Baraka Bank App

Utility Bill Payments

- Benefit: Effortlessly manipulate and pay your application payments immediately out of your phone, saving you time and trouble.

Mobile Top-Ups

- Benefit: Instantly recharge your mobile phone balance, ensuring you stay connected at all times.

Fee and Tax Payments

- Benefit: Conveniently handle your educational fees and government tax payments without visiting multiple offices.

Fund Transfers

- Benefit: Securely transfer funds between accounts, providing flexibility and peace of mind for your financial transactions.

QR Code Payments

- Benefit: Use QR codes for quick and easy payments at merchant outlets, enhancing your shopping experience.

Secure Mobile Banking

- Benefit: Enjoy maximum security for your banking activities, ensuring your financial information is protected

Roast Instant Payments

- Benefit: Benefit from Pakistan’s first instant payment service for seamless digital transactions with individuals, businesses, and government entities.

Also Read: Zarai Taraqiati Bank App

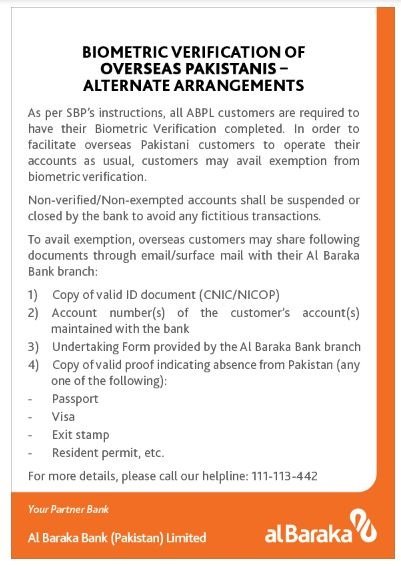

Security Measures in the Al Baraka Bank App

- Biometric Authentication: The app prioritizes security with biometric authentication options along with fingerprint and facial recognition, making sure only authorized get the right of entry.

- Secure Login Methods: Users can choose from a couple of login techniques, which include PIN codes and passwords, including an additional layer of safety to their debts.

- Encryption and Data Protection: All transactions and touchy information are encrypted, safeguarding client statistics from unauthorized get admission.

- Fraud Prevention Tools: The app employs advanced fraud detection algorithms, alerting users to suspicious activities and providing peace of mind.

User Interface and Experience

- Navigation and Layout: The app’s intuitive interface and individual-friendly layout make navigation seamless, even for first-time clients.

- Customization Options: Users can personalize their app experience with customizable settings, layouts, and notifications, enhancing user satisfaction.

- Accessibility Features: Accessibility is prioritized, with functions such as textual content-to-speech capability and shade assessment alternatives for visually impaired users.

Integration with Other Services

- Partnerships and Integrations: The app integrates with third-birthday party services, presenting extra functions like funding alternatives, insurance services, and loyalty applications.

- Additional Benefits: Customers revel in extraordinary offers, discounts, and promotions through the app, enhancing their universal banking experience.

Customer Support and Assistance

- Helpdesk Services: The application offers round-the-clock customer assistance ensuring that help is available, at all times.

- FAQs and Troubleshooting: Comprehensive FAQs and troubleshooting publications assist users in remedying commonplace troubles independently.

- Contact Options: Multiple contact channels, including live chat and phone support, ensure timely resolution of queries and concerns.

Benefits of Using the Al Baraka Bank App

The app’s benefits extend beyond convenience:

- Convenience and Time-saving: Instant get right of entry to to banking offerings from anywhere, each time.

- Enhanced Security: Robust security capabilities defend consumer facts and transactions.

- Exclusive Offers: Access to important gives and rewards, improving the banking experience.

Comparison with Other Banking Apps

The Al Baraka Bank App stands out with its:

- User-pleasant Interface: Easy navigation and seamless functionality.

- Security Features: Advanced security features for peace of mind.

- Additional Services: Integration with various financial services for comprehensive banking.

Future Developments and Updates

The financial institution is dedicated to continuous improvement, with upcoming updates focusing on enhancing personal revel and introducing progressive features based on purchaser feedback.

User Guide

View all my beneficiaries

- Log into your app

- Tap the transactional banking tile on the landing page to access your transactional banking features

- Click payment on the bottom

- All your beneficiaries will be listed in alphabetical order

View my Statements

- Log into your app

- Tap the transactional banking tile on the landing page to access your transactional banking features

- Click statements on the bottom

- Select account

- Click on the first date and select your date range from

- Click on the second date and select your date range to

- Click view

Create a Profile

- Click Create Online Banking account

- Complete your ID number

- Write your first name and last name and cell phone number

- Click next

- An OPT will be sent to your phone

- Insert 4-digit OPT number

- Capture a selfie and ensure your chin is at the bottom of your screen

- Capture a second photo

- Scan your ID

- Answer the knowledge-based question

- Accept the terms and conditions

- Create the password using the guidelines provided

How do I view my balances?

- Log into your app

- Tap the transactional banking tile on the landing page to access your transactional banking features

- Click the dropdown for switch account

- Click the account you wish to view

- Your available balance will be shown

More Read: Varo Bank Mobile App

Reset my Password

- Log into your app

- Click forgotten password

- An OTP will be SMSed to you

- Insert OPT

- Click next

- Capture a selfie and ensure your chin is at the bottom of your screen

- Capture a second photo

- Scan your ID

- Answer the knowledge-based question

- You will obtain sms with a brief password

- Once you log in with a temporary password, the gadget will set you to create a brand-new password

Security Tips – Use Your Banking App Safely

Using a banking app is handy, but it’s important to make certain your financial information stays secure. Here are a few extended hints to help you use your banking app adequately:

Choose Strong, Unique Passwords

- Create Complex Passwords: Use a mix of decrease-case and upper-case letters, numbers, and unique symbols (like !, @, #, and so on.) to create a sturdy password.

- Avoid Reusing Passwords: Using identical passwords throughout multiple sites will increase your chances. If one web page gets hacked, all of your accounts are inclined. Create a unique password specifically for your banking app.

- Password Management Tools: Consider using a password manager to keep track of your passwords. These programs can create strong passwords and securely store them.

Use Multiple Authentication Factors

- Two-Factor Authentication (2FA): Enable 2FA, which calls for a second shape of verification (like a code despatched for your cellphone) and further for your password. This gives another layer of safety.

- Three-Factor Authentication: Some banks provide even greater security layers, which include something you recognize (password), something you have (telephone or token), and something you’re (biometrics).

- Biometric Authentication: Use fingerprint scanning, facial reputation, or other biometric methods. These are harder for thieves to replicate compared to passwords.

Avoid Public Wi-Fi

- Risks of Public Wi-Fi: Public Wi-Fi networks, consisting of the ones in cafes or airports, are regularly no longer steady. Hackers can without difficulty intercept statistics transmitted over those networks.

- Use a VPN: When utilizing Wi-Fi employing a Virtual Private Network (VPN) secures your internet connection increasing the challenge for hackers to access your information.

- Prefer Mobile Data: Use your smartphone’s mobile data connection instead of public Wi-Fi for a greater steady right of entry to your financial institution account.

Use Trusted Apps

- Official Banking Apps: Download your economic organization’s legit app from a trusted dealer, just like the Apple App Store or Google Play Store. Avoid third-birthday celebration apps or links from emails and texts.

- Update Regularly: Keep your banking app updated to benefit from the contemporary protection capabilities and patches.

- Be Cautious with Permissions: Only provide the important permissions in your banking app. Avoid apps that require extensive access to your smartphone.

Monitor Your Accounts Regularly

- Check Statements: Regularly assess your financial institution statements and transaction records for any unauthorized transactions.

- Set Up Alerts: Enable SMS or electronic mail transaction indicators to acquire immediate account activity notifications.

Be Wary of Phishing Scams

- Be careful not to open any links: Exercise caution when it comes to emails text messages or any requests, for your banking information. Banks typically do now not ask for touchy information in this manner.

- Verify Contact Information: If you acquire a suspicious message, touch your bank with the use of reputable contact info to verify the authenticity.

Secure Your Device

Remember to update your software to keep it secure. Make sure your phone, devices, and apps are equipped with security patches.

- Utilize Antivirus Protection: Employ an antivirus program to shield your device from malware and other threats.

- Enable Screen Lock: Implement a screen lock feature such, as a PIN, pattern, or biometric lock to prevent access in case your phone is misplaced or stolen.

By adhering to these recommendations you can greatly enhance the security of your mobile banking activities. Safeguard your information, from risks.

Must Read: Askari Bank Mobile App

Conclusion

The Al Baraka Bank App is an exercise-changer in modern-day banking, imparting a constant, man or woman-friendly platform for all banking needs. With its robust features, seamless interface, and dedication to patron pleasure, it’s a must-have for everybody searching for a trouble-unfastened banking revel.