2Presenting the Alliant Credit Union App, your go-to solution, for banking in 2024. Our thorough evaluation showcases its standout features translated into advantages for comprehension. Enjoy effortless account management with balance inquiries prompt money transfers and bill settlements directly from your device. Your security is our priority, backed by encryption and real-time fraud detection to safeguard your information. Transparent pricing and straightforward policies prevent any surprises empowering you to stay informed. This application tackles banking challenges such as sluggish processing and complexity by providing speedy transactions and a user-friendly interface. Bid farewell to banking inconveniences. Welcome a safe and effective banking experience, with the Alliant Credit Union App.

Overview of Alliant Credit Union

Alliant Credit Union set up in 1935 is an acknowledged institution owned through its members and serving more, than 600,000 human beings across the USA. It is tremendously regarded for its prices and minimal costs providing economic services consisting of financial savings money owed, checking accounts, loans, credit cards, and investment options. The Alliant Credit Union App presents get right of entry to to account control capabilities like cell check deposits and bill payments together with monetary training assets. With its easy-to-use interface and robust security features, the app enhances the banking revel in, for users. Alliants’ willpower to supply customer support and expert financial recommendations distinguishes it from others within the enterprise helping individuals successfully pursue their goals.

Features of the Alliant Credit Union App

- Deposit Check: You can easily deposit checks anytime and anywhere, saving you a trip to physical branches and ensuring you get your money quickly.

- Easy funds management: Effortlessly transfer funds between your Alliant account and external organizations, making your financial transactions easier and saving time.

- Make Payment: Assign your Alliant credit card to the appropriate payment plan and track all your expenses in the app, making sure you pay on time to avoid late fees.

- Log in using Face ID or Touch ID: Enjoy a fast and secure login experience to your account with biometric authentication, increasing your peace of mind and reducing the risk of unauthorized access the right of way.

- Manage credit and debit cards: Easily manage your card status, payments, and information, and be sure to use cards responsibly and respond quickly to any card-related issues.

- Budget like a pro: Seamlessly integrate with popular budgeting tools like Mint and Quicken WebConnect, so you can better track your finances on the go and make smarter spending decisions.

Must Read: Meezan Bank Mobile App: Complete User Guide

Alliant Credit Union App Login

- Go to the Alliant Credit Union website.

- Find the button “Sign in” or “Sign in”.

- Enter your username and password.

- Click “Login” to access your account.

- Go to your account dashboard for banking services.

Alliant Credit Union Locations

Account Basics of Alliant Credit Union App

Checking:

Alliant Credit Union Advanced Review

Enjoy 0.25% APY income without monthly payments or minimum co-payment requirements. To receive this benefit, make at least one electronic payment each month, which can be direct or from a payroll deposit, an ATM or phone deposit, or from your funds from another bank Linking an Alliant savings account gives you a Visa debit card and free overdraft protection. In addition, checking dividends are paid on the last day of each month.

Alliant Credit Union Youth Survey

The account is designed for participants between the a long time of 13 and 17 and requires co-possession with a parent who is additionally a member. You won’t find any fees. Required minimum deposits and you’ll receive a 0.25% APY. The Visa debit cards come with limitations of $500, for ATM withdrawals and $500, for purchases..

Savings

Alliant Credit Union High Savings Bank

Alliant’s high-yield fund offers a competitive 3.10% APY. You can start with just $5 (which Alliant covers for you), but hold an average of $100 daily to earn a dividend. There is no monthly fee unless you opt for a paper card, which costs $1 per month.

Alliant Credit Union Savings Bank

Once you have a stable savings account, you can open up to 19 new accounts for savings goals. Every account gets the same high APY. Keep a minimum of $5 per account, and the remaining $100 distribution will apply to each account

Alliant Credit Union Children’s Savings Account

Children under the age of 12 can team up with an Alliant member adult to create their own high-yield savings account. Alliant pays a $5 opening storage fee, and there is no monthly fee for electronic information (paper information costs $1 per month). Hold on to the remaining $100 for a higher APY.

CDs (Share Certificates)

Alliant Certificate of Deposit (CD)

Alliant Credit Union provides a selection of certificates of deposit (CDs) known as Alliant Credit of Deposit. These CDs come with maturity dates that span from 3 months to 60 months. They feature percentage yields (APY) that are on par with top CD rates. However, individuals interested in opening a CD must hold a membership, with Alliant Credit Union.

Alliant Credit Union CD Rates

- 3 Month: 4.25%

- 6 Month: 5.00%

- 12 Months: 5.15%

- 18 Months: 4.90%

- 24 Months: 4.30%

- 36 Months: 4.20%

- 48 Months: 4.05%

- 60 Months: 4.00%

You need $1,000 to start a Certificate, with Alliant. The dividends, on Alliant Certificates are compounded every month.

Alliant IRA Certificates:

When it comes to saving for retirement Alliant provides Traditional IRA, Roth IRA, and SEP IRA Certificates that earn the Annual Percentage Yield (APY) as the Alliant Certificates. The minimal quantity required to open this IRA certificate is likewise set at $1,000.

Other Accounts and Services:

Aside, from providing banking services Alliant Credit Union also offers a variety of services such, as;

- Credit cards

- Home loans

- Vehicle loans

- Personal loans

- Commercial real estate lending

- Traditional, Roth, and SEP IRAs

- Trust accounts

- Custodial accounts

- Life, home, and auto insurance

Alliant Credit Union Overdraft Fees

Alliant Credit Union sticks out for its client-pleasant technique by way of no longer charging for overdraft expenses. In a landmark circulate in 2021, the credit score union announced the removal of overdraft fees on all its portfolios and financial savings bills. This method underscores Alliant’s commitment to providing obvious and truthful banking offerings so that you can gain its participants using assistance to avoid unexpected prices and promote responsible economic control.

Alliant Credit Union ATM Fees

Alliant Credit Union stands out for its ATM price rules, which advantage its contributors in numerous approaches:

- No ATM Fees: Alliant no longer rates ATM expenses, supplying participants with a convenient and price-powerful right of entry to cash.

- Free ATMs: Access to over 80,000 unfastened ATMs nationwide through their respective banks lets members withdraw cash without the trouble of surcharges.

- ATM Fee Discount: Even if you use a non-network ATM, Alliant offers a reduction on their ATM operator fees, up to $20 consistently per month. This can store frequent ATM users as a lot as $240 a yr.

- Instant Discounts: Alliant usually applies these discounts on your account within one commercial enterprise day, making sure you get your money fast without waiting.

Overall, Alliant Credit Union’s ATM fee guidelines show their dedication to providing convenient, cost-effective banking answers for their contributors.

Alliant Credit Union Foreign Transaction Fee

Alliant Credit Union fees a 1% foreign transaction charge for all international debit card purchases and ATM withdrawals. Also called the worldwide carrier evaluate fee, this Alliant $20 ATM month-to-month cut price is not included, which means that you may pay this charge one at a time whilst using your card or creating a withdrawal outdoor the USA.

How Alliant Credit Union Stacks Up:

Alliant Credit Union’s robust online and cellular banking equipment makes it a relied-on preference for folks who enjoy virtual banking. The recognition of Alliant’s extraordinary checking money owed on Forbes Advisors’ list of exceptional take a look at debts similarly underscores its quality.

Alliant makes saving easy with competitive APYs and new goal-focused savings accounts. The low barrier to membership and transparent payment process add to its appeal and ensure customers understand and benefit from the offer.

Alliance Credit Union vs Ally:

Compared to Alliant Credit Union and Ally Bank, the most effective online banks to offer competitive prices and occasional prices for a variety of banking products and services, Alliant excels in savings and debit card hobby rates, making it suited in those areas. On the other hand, Ally shines in certificates of deposit (CDs). The benefit of Ally is that there aren’t any minimum deposit necessities and a massive selection of CDs. So depending on your specific banking desires, Alliant and Ally provide one-of-a-kind benefits that might be worth considering.

Alliant Vs. Other Traditional Banks:

Alliant operates as a not-for-profit organization, which means it can offer higher interest rates and lower fees compared to traditional banks. This program benefits by providing excellent financial returns to members.

Alliant vs. Other Online Banking:

Compared to other online banks, many of Alliant’s financial products and services are noteworthy. In addition, its commitment to strong member satisfaction sets it apart, making it popular with those looking for a complete online banking experience

Pros:

- A competitive APY for bank accounts, helps you grow your money faster.

- There are no overpayments, avoiding unexpected fees while providing financial peace of mind.

- A checking account offers sharing without the need for capital, which rewards your banking performance regardless of your account balance.

- With, more than 80,000 ATMs available our network allows for cash withdrawals at no extra cost.

Cons:

- There aren’t any physical locations, which might prove troublesome for individuals seeking banking services.

- Children’s savings accounts must be opened before the age of 12, limiting the options available to older children or teenagers.

- The $1 monthly fee for a paper subscription for a bank account, can increase your banking costs if you prefer paper information over digital information.

Protecting Your Accounts

Send Secure Messages

Contact our Member Care Center with any questions about your account. Please be assured that our secure system is designed to protect and store your personal information and ensure a safe and confidential experience.

App Updates for Account Security

We often improve our app to include today’s safety protocols to make sure our customers enjoy the most advanced safety in opposition to emerging threats. Our dedication to keeping up-to-date safety features guarantees a safe and stable enjoyment for all users.

Report Lost/Stolen Credit or Debit Cards

On the unlucky occasion of losing your credit or debit card, sincerely notify us through our cellular app, where you can fast order a replacement card with only a few faucets on the screen. Our app simplifies this manner and guarantees minimal hassle and brief resolution, so you can keep handling your budget without interruption.

Two-Factor Authentication

To grow login security, consider signing in to Alliant -thing authentication. This characteristic affords an additional layer of safety and guarantees that the simplest legal customers can access your account. It provides every other step to the login manner, making it extra secure and protecting your account from unauthorized right of entry to tries.

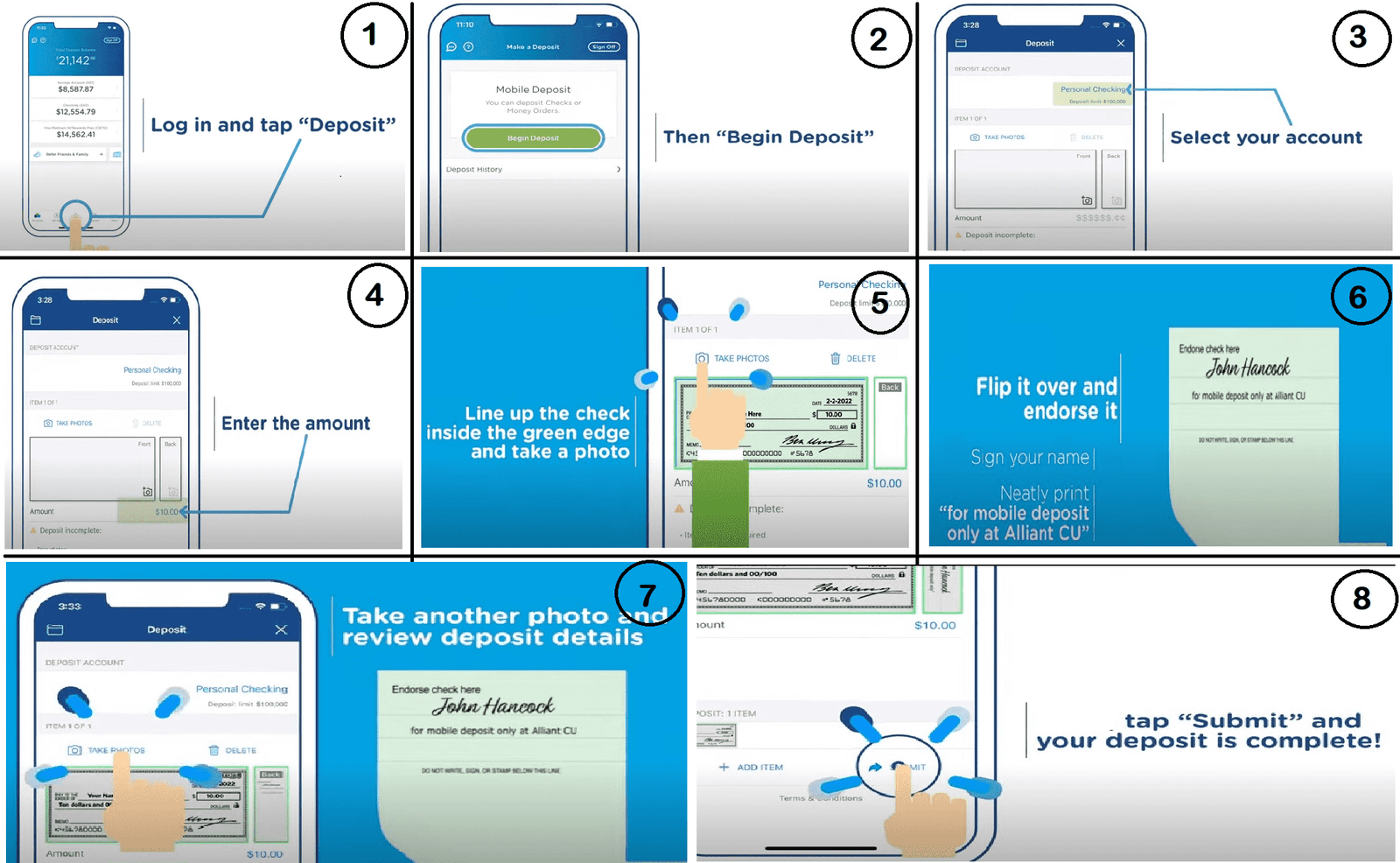

How to Use the Alliant Mobile App to Deposit a Check

To deposit a test of the usage of the Alliant cellular app:

- Open the App: Launch the Alliant Mobile app for your cellphone or pill. If you do not have the app, download it from the App Store (iOS) or Google Play Store (Android) and check in to your Alliant account. Go to

- Deposit Checks: After logging in, visit the “Deposit Checks” or “Mobile Deposit” phase. This choice is commonly determined in the main menu or home display of the application. Select

- Account: Select the account you need to deposit and take a look at into. Enter Check Amount: Enter the amount of the take a look at you are depositing.

- Endorse a Test: Sign the return take a look at and write “For mobile deposit only” under your signature.

- Take Pictures: Use the app’s camera to take snapshots of the front and back of the approved check. Make sure the take a look at is obvious within the photos.

- Verify Details: Review and take a look at snapshots and portions to ensure accuracy.

- Submit Deposit: Confirm your deposit info and post a test deposit through the app. The software may require extra verification steps inclusive of test amount affirmation or digital take a look at confirmation.

- Wait for Confirmation: After sending a deposit, wait for affirmation that the deposit has been received and processed. It typically takes some enterprise days.

- Check Retention: Once the deposit is shown, you can preserve the physical test in your records or accurately dispose of it.

Be positive to observe any precise commands or hints furnished with the aid of Alliant Credit Union for mobile test deposits to ensure a smooth and successful transaction.

Alliant Credit Union Customer Service

Alliant Credit Union provides exceptional customer service with a focus on accessibility and support. They offer 24/7 customer service and a variety of contact methods, ensuring members can easily get assistance. Their representatives are known for being friendly, knowledgeable, and efficient, helping with everything from account inquiries to lost or stolen cards.

1. Alliant Credit Union Phone Number

- Domestic: 800-328-1935

- International: 773-462-2000

- Credit Card: 866-444-8529

- ATM/Debit Card: 800-328-1935

2. Alliant Credit Union Routing Number

- 271081528

3. Alliant Credit Union Address

- Alliant Credit Union 11545 W Touhy Avenue Chicago, IL 60666

FAQs

1. How many system requirements are there to utilize the Alliant mobile banking app?

The application is well suited to both iPhone and Android smartphones with Apple iOS or Google Android operating structures. It supports an extensive range of gadgets:

- Apple iOS: Versions 12 to 16 are supported.

- Android OS: Versions 7 to thirteen are well suited.

We thoroughly check all app updates on various gadgets, such as gadgets from Apple, Samsung, Google, LG, Motorola, OnePlus, and Nexus, ensuring easy performance across systems and fashions.

2. Is my money safe at Alliant Credit Union?

Yes, your coins are safe with Alliant Credit Union. Alliant deposit money owed is insured with the aid of the National Credit Union Administration (NCUA) as a good deal as $250,000 regular with the depositor, on the extent of account possession inside the event of a credit score rating union failure. This coverage gives your cash peace of thoughts and protects you.

3. Does Alliant Credit Union have branches?

No, Alliant Credit Union does not have bodily branches. Its headquarters are located in Chicago. However, it offers a guide via online services and a cellular app. In addition, individuals can get the proper entry to a community of over 80,000 ATMs for their banking goals.

4. Does Alliant Credit Union charge monthly fees?

Alliant Credit Union does not price monthly preservation expenses. However, in case you choose a paper statement, there’s a $1/month price. In addition, massive costs apply for offerings which consist of a Shortage of Funds (NSF) and check printing.