The mobile application, from Askari Bank has transformed the banking industry by providing a convenient method for users to handle their finances while on the move. Featuring an interface and a variety of functions this app offers a banking solution at your convenience. Whether it is dealing with money owed, paying bills, or moving budget the Askari Bank Mobile App permits customers to manage their duties regardless of where they may be. This blog explores the key capabilities, blessings, and user manual of the Askari Bank Mobile App, highlighting its function in simplifying banking tasks and improving the general patron’s enjoyment.

Key Features of the Askari Bank Mobile App

The Askari Bank Mobile App provides a huge variety of features designed to enhance banking enjoyment for its users. Here’s a detailed rationalization of its key capabilities:

Account Management

- Check Account Balances: Users can see their account balances instantly giving them access, to their situation.

- Review Transactions: The application enables users to examine transaction records showing both outgoing transactions, which aids in monitoring finances.

- Access Statements: Users can create and view account statements, within the application itself helping with improved organization and record keeping.

Must Read: Meezan Bank Mobile App: Complete User Guide

Fund Transfers

- Interbank Transfers: With the app users can easily move money between Askari Bank accounts and other banks, in Pakistan through NEFT, RTGS, and IMPS.

- Standing Instructions: Users can create standing instructions, for recurring transfers making it easier to handle payments.

- Instant Transfers: The app allows for fund transfers guaranteeing hassle-free transactions.

Bill Payments

- Paying Bills: With the app, users can conveniently settle their utility bills for services, like electricity, water, gas, and telecom.

- Additionally, they can easily manage their credit card payments through the app streamlining the process and avoiding tasks.

- Moreover, users have the option to top up their phones within the app eliminating the reliance, on physical recharge cards.

Account Services

- Users have the option to order checkbooks conveniently via the app, which helps save time and effort.

- The app provides functions, for handling debit cards, such as activating, blocking, and adjusting transaction limits.

- Additionally, users can easily update their details, like contact information, address, and email directly within the app.

Financial Planning Tools

- Loan Calculators: This application offers tools for users to calculate loan EMIs, tenure, and interest rates assisting them in planning their finances.

- Savings Goal Trackers: Users can set savings goals and track their progress regularly, encouraging the development of good saving habits.

- Investment Insights: The app offers investment insights and marketplace updates, empowering users to make knowledgeable funding selections.

Security Features

- The application ensures a login process by using security measures, such, as biometric authentication (fingerprint or face recognition) and OTP verification.

- Additionally, users are prompted for transaction verification to enhance security and prevent transactions.

- Moreover, all information transmitted through the application is encrypted to protect user data from access.

Customizable Alerts and Notifications

- Users have the option to receive notifications, for transaction types account balances, and payment deadlines to stay updated on their matters.

- The application also provides security alerts for any activities or unauthorized login attempts to ensure account safety.

- Furthermore, customers can anticipate receiving updates on promotions, savings, and special offers provided by Askari Bank.

The combination of these characteristics makes the Askari Bank Mobile App a complete and easy, to use tool, for handling finances carrying out transactions, and accessing banking services conveniently and securely.

Also Read: HSBC Mobile Banking App

Enhanced Security Features

Easy Explanation of Enhanced Security Features in Askari Bank Mobile App

- Biometric Authentication; You have the option to use your fingerprint or facial recognition to access the app providing a layer of security. You can configure this feature within the app’s settings.

- Session Login Alerts; Each time you sign up to the app you will receive either an electronic mail or text message alert. In case of inactivity, the app will automatically log you out to ensure the protection of your account.

- Brand Protection; The app is equipped with security measures to prevent duplication or cloning thereby safeguarding your account from potential breaches.

- 2-Hours Cooling-Off Period on Limit Management: If you change your transaction limits, there’s a 2-hour waiting period before the changes take effect. This helps prevent fraud by giving you time to review and confirm the changes.

When you set up the app on a device, you must confirm your identity using biometrics. This is done to make sure that only approved devices can log into your account in line, with security regulations.

Step-by-Step Guide to Using Askari Bank Mobile App

Downloading the App

- Navigate to your device’s App Store or Google Play Store.

- Look up “Askari Bank Mobile App” in the search bar.

- Install the app by tapping the app icon and choosing “Download” or “Install.”

Minimum Operating System Requirements for Askari Bank Mobile App

- iOS: To access the Askari Bank Mobile App you must have iOS 13 or a recent version installed on your device.

- Android: To use the Askari Bank Mobile App on Android devices you must have Android version 6 or above installed.

Logging In

- Open the App: Tap on the Askari Bank Mobile App icon on your device.

- Enter Username and Password: Please enter your username and password, for Askari Bank.

- Tap “Log in“: To access your account, click the “Log In” button.

Activation Process

- Receive Activation Code: You will receive an activation code on your registered mobile number or email.

- Enter Activation Code: Input the activation code received.

- Verify Details: Confirm your details for security purposes.

- Complete Activation: Follow on-screen instructions to complete the activation process.

Setting Up Password

- Access Security Settings: Go to the app’s settings menu.

- Select “Change Password”: Locate the option to change or reset your password.

- Enter Current and New Password: Input your current password and set a new secure password.

- Confirm Password Change: Confirm the new password to update your account’s password.

Bill Payment

- Login to your Mobile Banking App

- Select Bill Payments and then Select Account from the PAY FROM option

- Select E-Commerce as the Company Type and then Select Kuick Pay as the Bill Company

- Enter or select the consumer number & then click Next.

- Confirm details and click Next

- Generate and enter Financial Pin

- Click Submit to pay

Transaction Process

- Access Transactions: Navigate to the “Transactions” or “Payments” section.

- Select Transaction Type: Choose the type of transaction (e.g., fund transfer, bill payment).

- Enter the Transaction Details: Enter the recipient information, amount, and transaction purpose.

- Verify and Confirm: Review transaction details and confirm the transaction.

Account Management

- View Account Details: Access your account dashboard to view balances and recent transactions.

- Manage Transactions: Review and manage incoming and outgoing transactions.

- Update Personal Information: Navigate to the settings menu to update personal details.

- Order Checkbook: Use the app to make an order for a new checkbook.

More Read: CitiBank Mobile App

Interface

Login Process

When you open the app, you may see a screen wherein you want to enter your username and password. You can also use your fingerprint to quickly login without having to enter credentials every time.

Missing “Forgot Password” Option

Unlike some apps, there’s no “Forgot Password” option on the login screen. You’ll only find it after logging in. It would be helpful to have it outside the app too, especially if you haven’t set up a fingerprint login.

Additional Features on the Login Screen

The login screen also includes opportunities to reach Askari by email or phone. You can also access exclusive discounts and apply for loans like car loans, agriculture loans, and Islamic loans without interest.

Placement of Features

Some features on the login screen require you to log in first, which seems a bit confusing. It would be more natural to have these options available within the app after logging in.

Navigating the login screen & its features is straightforward and user-friendly.

Main Menu

Display of Account Details

The main menu of the app prominently displays sensitive information like account type, account number, and account balance at the top. While this is convenient for quick access, it can pose privacy issues in public settings. Users may prefer to have the option to hide these details by default and reveal them only upon touching their account details.

Bug with Account Balance Display

Occasionally, customers might also stumble upon an issue where the account stability is indicated as “N/A” due to a malicious program inside the app. Although this worm may additionally cause preliminary concern, it’s crucial to notice that it is a minor problem within the app’s trendy model and not a reason for alarm.

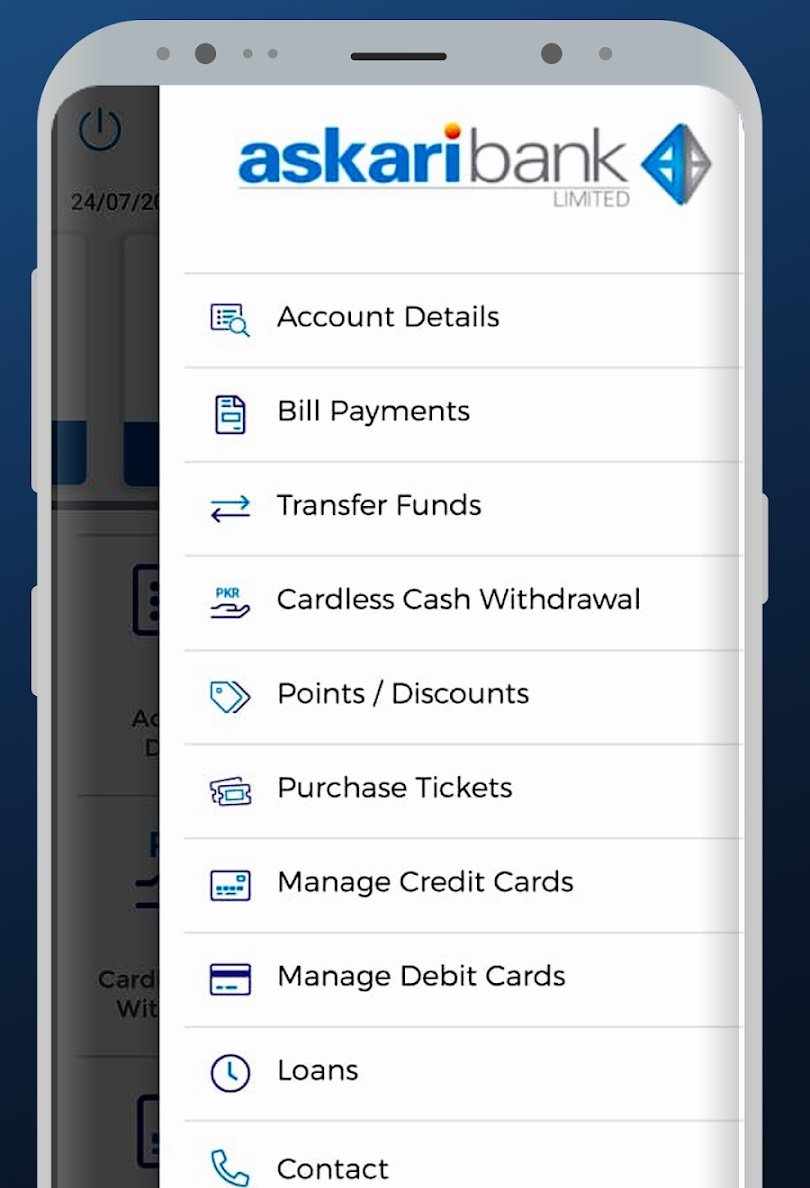

Redundant Sidebar

Hamburger Menu Redundancy

The hamburger button, located at the bottom right of the app, opens a menu duplicating many main menu features, like Account Details and Bill Payments. This redundancy makes navigation cumbersome and could be improved by adding unique features here instead.

Streamlining Account Management

Separating features like ‘Account Statement’ from ‘Account Details’ creates confusion. For better organization, these should be combined or consolidated into a single, easily accessible location.

Efficient Card Management

The app’s Card Management section is split between the main menu and the hamburger menu, which is unnecessary and wastes space. Consolidating these into one category would simplify navigation.

Unified Payment Options

Grouping payment features like buying tickets and bill payments under one tab called “Payments” would enhance clarity and ease of use.

Clarifying Rewards Points

The “Points/Discounts” section lacks clarity on Digital Banking Reward Points, necessitating clear explanations within the app to avoid user confusion.

Enhanced Search Functionality

Some app sections lack a search feature, leading to inconvenient scrolling. Implementing a universal search option would improve user experience and save time.

By addressing these navigation and usability issues, the Askari Bank Mobile App can provide a more user-friendly and efficient banking experience.

Conclusion

The Askari Bank Mobile App stands proud as a transformative device inside the banking industry, imparting users an unbroken and green way to manipulate their price range. Despite some navigational and usefulness challenges discussed, together with menu redundancies and a shortage of clarity on certain functions, the app’s general capability and comfort can not be ignored. With continuous improvements and upgrades, the Askari Bank Mobile App has the potential to become a leading choice for modern banking wishes, supplying clients with a comprehensive and person-pleasant platform for their monetary transactions.

FAQs

1. how to make an account on the Askari Bank mobile app?

To create an account at the Askari Bank Mobile App, observe these steps:

- Download and Install the App: Head over to either the Google Play Store or Apple App Store to install and configure the Askari Bank Mobile App on your smartphone.

- Open the app: To start the application, choose its icon from your device’s screen.

- Register or Login: If you’re new here click on the “Register” or “Sign Up” option. Existing customers can log in with the use of their credentials.

- Fill out the registration form: Complete the registration form with your name, CNIC number, contact information, and email address.

- Verify Identity: Follow the app’s commands to affirm your identification. This may additionally include biometric verification or entering an OTP sent for your registered cell quantity.

- Set Up Security: Choose a robust password and set up any extra security measures presented with the aid of the app, along with biometric authentication.

- Complete Registration: After imparting all required records and finishing the verification manner, your account registration may be entire.

- Access Account Features: Once registered, you can get entry to various capabilities of the Askari Bank Mobile App, together with account details, fund transfers, bill payments, and more.

2. How to activate the Askari Bank mobile app?

To activate the Askari Bank Mobile App, observe the steps:

- Download and Install: To begin you can get the Askari Bank Mobile App by downloading and installing it from either the Google Play Store or the Apple App Store on your smartphone.

- Open the App: Start the application by tapping on its icon located on the screen of your device.

- Register/Login: If you’re a new person, sign up with the aid of presenting your data and developing a username and password. Existing users can log in for the usage of their credentials.

- Verify Identity: Follow the app’s directions to validate your identification. This can also encompass coming into an OTP (One-Time Password) sent in your registered cellular quantity or electronic mail.

3. How do I check my Askari account balance?

To test your Askari account balance the usage of the app, observe these preferred steps:

- Open the Askari Mobile Banking App on your telephone.

- Log in to your account using your username and password or any other authentication method required.

- Once logged in, navigate to the option or menu classified “Account Balance” or “Check Balance.” This option is commonly found on the home display screen or inside the essential menu of the app.

- Select your favored account when you have more than one account associated with your profile.

- The app will then show your cutting-edge account balance.