Uncover the handbook, for using the BBVA Mobile Banking App! Master how to explore its functions and enhance your banking journey. This user-friendly app simplifies your responsibilities from managing accounts to paying bills. Delve into in-depth evaluations showcasing its top-tier features and excellent user interface. Discover why BBVA is recognized as a player in banking worldwide. Whether you’re new to banking or an experienced user this manual provides you with all the information you need, about the BBVAs application.

Key Features of BBVA Mobile Banking App

The mobile banking app, from BBVA provides users with features aimed at improving the banking experience. Let me break down some of its features for you;

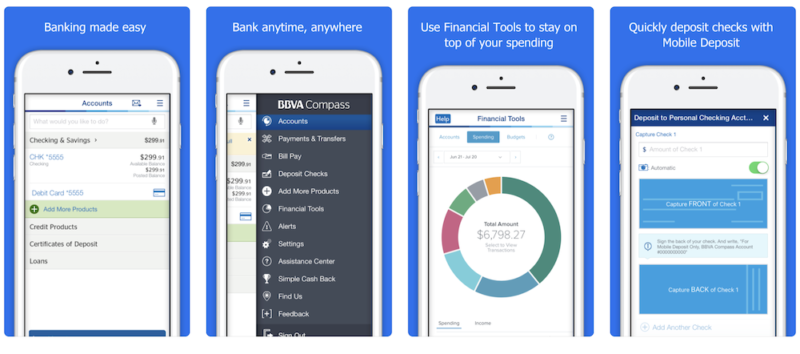

- Account Management: Users can easily check their account balances view transaction history and handle accounts all in one place. This feature makes it easy to keep track of your finances seamlessly.

- Mobile Check Deposit: With this app, users can deposit checks remotely by taking a photo of the check. No need to visit a bank branch for this task anymore.

- Bill Payments: Users have the convenience of paying bills through the app setting up recurring payments and efficiently managing payment schedules.

- Transfers and Payments: The app allows for transfers between BBVA accounts and external accounts as well as peer-to-peer payments using Zelle®.

- Security Features: The BBVAs app incorporates security measures like biometric login options (fingerprint or facial recognition) alerts for activities, on your account, and the ability to instantly lock/unlock your debit cards.

- The app’s budgeting tools enable users to monitor their expenses establish budget objectives and gain insights into their spending habits.

- For assistance, with banking queries, users can access customer support services such as chat support and FAQs.

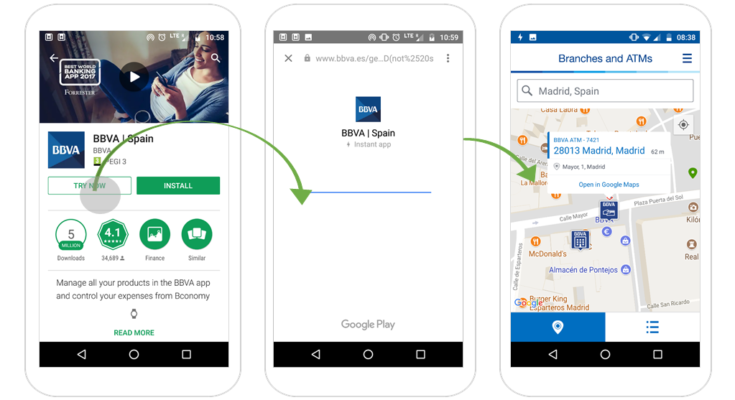

- Additionally, the app’s integrated ATM locator feature allows users to find BBVA ATMs and branches easily.

Together these functions provide users with a convenient banking experience empowering them to manage their finances while on the move.

User Guide

Downloading the App

- Head to your device’s app store (Google Play Store for Android or App Store for iOS).

- Search for “BBVA Mobile Banking” in the search bar. Select the app by BBVA.

- Tap, on the “Install” button to get the app on your device.

Logging In

- Once you have the app installed simply tap on the app icon to open it.

- When you reach the login screen input your BBVA online banking username and password.

- If you are new and don’t have an account yet just choose the “Sign Up” or “Register” option to set up an account.

Activating the BBVA Mobile Banking App

- After you log in you might have to confirm your identity, for security reasons. This might include typing in a code sent to your email or phone number.

- Just follow the instructions on the screen to add security measures like fingerprint or facial recognition, for logins.

- Once that’s done you’re good to go Can begin using the app to handle your accounts make payments deposit checks and use banking services.

Managing Account:

- Login: Please access the BBVA Mobile Banking App. Sign in, with your account details

- Account Overview: After logging in you’ll be able to view a summary of your accounts showing balances and recent transactions.

- Check out the account details by tapping on any account to see all the specifics, like transaction history account statements, and pending transactions.

- Make changes, to information set up alerts, and handle security features in the account settings.

Check Deposit Through BBVA Mobile Banking App

- Choose Deposit: Locate the check deposit option, within the app typically found under either the “Deposits” or “Transactions” section.

- Endorse the Check: Before depositing sign the back of the check following the instructions provided in the app.

- Take a Picture: Utilize the camera function in the app to snap photos of both sides of the endorsed check.

- Input Deposit Information: Input the deposit amount choose the account, for the deposit. Verify the transaction.

Bill Payment:

- Head to the Bill Payment section, in the app. Look for the option to pay your bills usually labeled as “Pay Bills” or something similar.

- Add a New Payee by entering the recipient’s details such, as their name, account number, and the amount you wish to pay.

- Choose the Payment Schedule based on when and how you want to make payments whether it’s a one-time payment or recurring.

- Review all Payment Details carefully before confirming and initiating the bill payment procedure.

Transfer Payment:

- To transfer funds navigate to the “Transfers” or “Send Money” section, in the app. Next, pick the recipient from your list of saved contacts.

- Add a recipient by providing their information. Finally enter the desired amount, for the transfer.

- Confirm Transfer: Review the transfer details, including the destination account, and confirm to complete the transfer.

Security Features of BBVA Mobile Banking App

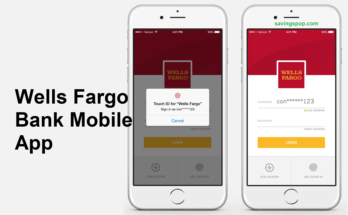

- Biometric Authentication: The application provides options, for verification like fingerprint or facial recognition to securely log in.

- Encrypted Transactions: All transactions are ciphered to safeguard data from entry.

- Account Notifications: Users can configure alerts for activities on their accounts receiving notifications of any irregular account actions.

- Immediate Debit Card Control: The application enables users to promptly lock or unlock their debit cards for security, in situations of theft or misplacement.

Budgeting Tools:

- Managing Expenses: The application automatically. Organizes expenses, offering users insights, into their spending patterns.

- Budget Planning: Users can establish budget targets for categories and monitor their advancement over time.

- Financial Well being Assessment: BBVAs technology-driven resources assess well-being. Offer suggestions, for enhancing budgeting and saving practices.

- Setting Objectives: Users can define objectives with the assistance of the app whether it be saving up for a trip or a significant acquisition.

Customer Support Features:

- Users can chat live for help, with banking questions within the app.

- Additionally, there are FAQs and tutorials for self-assistance and problem-solving.

- If needed users can also reach out to their advisor through the app, for help.

- BBVA provides 24/7 customer support to address any banking queries or issues users may have.

Also Read: CitiBank Mobile App

Review of BBVA Mobile Banking App:

Pros:

- User-friendly interface, for effortless navigation.

- security measures for a worry experience.

- Smooth integration, with services.

- Helpful customer support choices that respond promptly.

Cons:

- Occasionally users might encounter issues, with the app.

- Advanced users have limited choices, for customization.

Conclusion

The BBVA Mobile Banking App is a standout option, for banking needs due to its user design and comprehensive features. The strong security measures, like login and encrypted transactions, ensure a banking environment. Users can benefit from the app’s budgeting tools to monitor expenses establish budgets and enhance well-being. Additionally, the customer support options, such as chat and round-the-clock assistance add to the convenience for users. Overall BBVAs focus on security, financial management, and customer care positions its mobile banking app as a pick, for those seeking an effective banking experience.

FAQs

1. Is the BBVA Mobile Banking App free to use?

You can. Use the app for free. Remember that standard data rates may apply.

2. Can I deposit checks using the app?

Yes, the app allows you to conveniently deposit checks using its mobile check deposit feature.

3. Are there any charges, for transactions on the app?

Some transactions like wire transfers or expedited bill payments may come with fees. It’s best to refer to the app for information, on fees.

4. Is my personal information safe when using the BBVA app?

Rest assured BBVA has implemented security measures to safeguard your financial details.