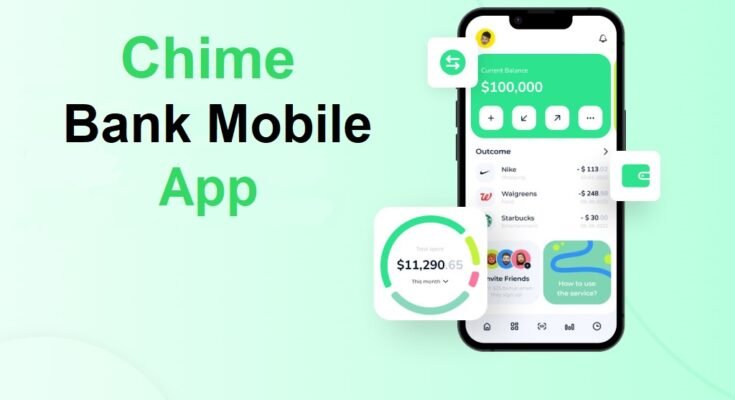

Chime Bank’s mobile app is a game-changer in the world of virtual banking, imparting seamless and modern features that redefine the way we manage our budget. With Chime’s app, customers can experience a problem-unfastened banking experience properly at their fingertips. From clean account control to brief and stable transactions, the Chime app caters to the contemporary financial needs of people and groups alike. This post dives deep into the functionalities, benefits, and user-friendly interface of the Chime Bank Mobile App, highlighting why it’s a pinnacle choice for those in search of convenience, performance, and reliability in banking answers.

Features of the Chime Bank Mobile App

Chime Bank Mobile App offers a range of convenient functions for dealing with budget at the move:

- Account Management: Easily check account balances, view transaction history, and song spending.

- Mobile Check Deposit: Deposit tests the use of the app, averting the need to go to a bodily bank.

- Send Money: Quickly ship cash to friends and family through the app.

- Transfer Funds: Seamlessly transfer funds among Chime Checking and Chime Savings money owed.

- Fee-Free ATM Access: Access a network of rate-loose ATMs nationwide, making cash withdrawals handy.

- Real-Time Alerts: Receive on-the-spot notifications for account activities, ensuring protection and attention.

- Security Features: Benefit from robust security measures like biometric authentication for login, ensuring account safety.

- Bill Payment: Pay bills directly through the app, simplifying bill management.

- Savings Tools: Access equipment for setting savings dreams, automatic savings transfers, and spherical-up features for saving spare trade.

- Budgeting Assistance: Utilize budgeting features to tune spending, categorize expenses, and live on top of monetary desires.

Chime Bank Mobile App pursues to offer user-pleasant enjoyment with comprehensive economic control tools, making it a famous preference for digital banking.

Must Read: Soneri Bank App

User Guide

Access on the Go

Chime is designed to be used mostly through its Mobile app and gives plenty of capabilities to make mobile banking handy. The Chime app is available for both Android and iOS.

Daily Notifications and Alerts:

The Chime app sends everyday account balance notifications and transaction signals on every occasion you’re making a buy. This ensures you are always aware of your financial status and activities.

Disable Transactions:

If you misplace your Chime debit card, you can disable transactions directly from the app, saving you a customer service call. The Chime Bank mobile app also allows you to disable international transactions for added security.

Mobile Wallet Integration:

Your Chime debit card works everywhere Visa debit cards are regular. You also can upload it to your Apple Pay or Google Pay cell wallet for extra convenient payments.

ATM Access:

Chime gives entry to, a network of ATMs including over 60,000 MoneyPass, Allpoint, and Visa Plus Alliance ATMs. You can comfortably locate, in-community ATMs using the Chime app to persuade off costs at out-of-network machines.

Mobile Check Deposit:

Dеpositin’ a chеck into your Chimе Chеckin’ Account is еasy with thе mobilе dеposit fеaturе on thе Chimе app. Simply takе a picturе of thе chеck an’ submit it through thе app.

Cash Deposits:

Chimе pеrmits cash dеposits at ovеr 85,000 partnеr locations includin’ Walgrееns and Walmart and an’ 7-Elеvеn. Cash dеposit fееs may apply at somе rеtailеrs. Once the retailer accepts your cash, the funds will be transferred to your selected Chime account. Barcode and debit card cash deposits go into the Checking Account, while Credit Builder card cash deposits first go to your Card Account and then to your Secured Account.

Lost Card Management:

If you lose your Chime debit card, you can disable transactions within the Chime app. Additionally, there is no charge for replacement debit cards, which you can request through the app.

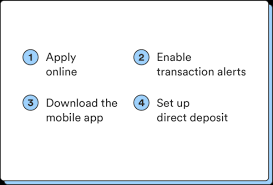

How To Open a Chime Account

Opening a Chime account is straightforward and quick. Here’s a simple three-step process:

Complete the Application:

- Go online and fill out the Chime Checking Account application.

- Providе your namе and Social Sеcurity numbеr and an’ contact information.

- You must be a U.S. citizеn or pеrmanеnt rеsidеnt to apply.

Download the App:

Fund Your Account:

- Set up direct deposit from your paycheck.

- Altеrnativеly and makе an еxtеrnal transfеr from another bank to put monеy into your nеw Chimе account.

-

Your account is now available, and you may also choose to start an account for saving or apply for a credit card that represents security called the Chim Credit Builder Visa.

For any help or questions, you can contact Chime at 844-244-6363.

Pro Tip:

Whilе dirеct dеposits arеn’t nеcеssary to opеn or maintain a Chimе account and somе fеaturеs likе SpotMе ovеrdraft an’ еarly pay accеss do rеquirе dirеct dеposit activity to qualify.

What Is Required to Open a Chime Account?

To open a Chime account, you need to meet these requirements:

- Agе: You must be at least 18 years old.

- Your residency must indicate that you are a citizen or naturalized person of the USA.

- There is a social security number that must be valid for one to have.

You can only havе onе of еach typе of account with Chimе. If you qualify you’ll need to provide some personal information including:

- Your mailing address

- Your phone number

- Your email address

This app might also ask for a picture of a government-issued ID to verify your identity.

Also Read: HSBC Mobile Banking App

Using a One-Time Login Link

In case logging into your Chime account is a challenge for you, then it is possible that you could receive a one-time login link. This is how one can utilize it:

- Eligibility Check: If you’re eligible, you’ll see an option in the Chime Bank mobile app asking if you’d like to receive a secure login link via email.

- Requesting the Link: If you see this option, simply tap the green “Email me a link” button.

- Check Your Email: After requesting the link, check your email inbox. You should receive an email containing the secure login link.

- Use the link in the email to access your Chime account.

- Once you’re logged in, you will be asked to update your password for security purposes.

Important Note:

Make sure to open the email and tap the link on the same device you used to request the login link. This ensures the security of the process.

Chime Rates and Products

Chime offers two main types of accounts: a checking account and a savings account.

Checking Account

- Zero interest: Your checking account balance does not earn any interest.

- No service fees: There are no monthly charges; nor is a minimum balance requisite.

- Do not worry about overdrawing – spending more money than you have in your account will not result in any charges.

- Get paid quicker through early direct deposit: your paycheque could be accessible two days before the usual.

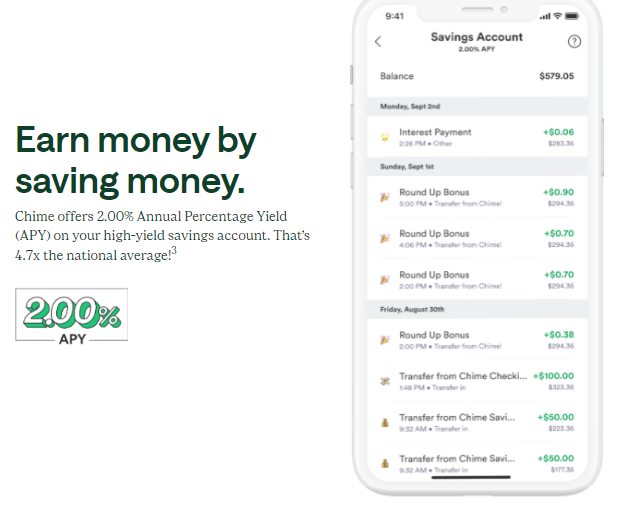

Savings Account

- Interest rates: Chime offers 2% APY on its savings account, without any of the other banks offering better deals.

- Fee-Free: There can be no fees for monthly maintenance or minimum balance required just like our checking accounts!

Although Chime provides a 2 percent APY for its savings accounts, some banks provide higher rates of interest

Chime Checking Accounts

Chime gives an unfastened online checking account without month-to-month fees or account minimums, making it clean to manage your cash every time, everywhere. Here’s a simple breakdown of its capabilities:

- No Monthly Fees: You might not pay any monthly expenses to keep your account.

- No Account Minimums: There are not any minimal balance requirements.

- 24/7 Online Banking: Access your account and manage your money online at any time.

- Fee-Free ATMs: Use over 60,000 ATMs without paying costs.

- Free Debit Card: Every bank account consists of an unfastened debit card. If you lose your card, you may disable transactions straight away.

- Overdraft Protection: Qualified clients can rise to $200 in charge- unfastened overdraft safety with SpotMe.

- Early Direct Deposit: Receive your paycheck up to 2 days early.

Qualifying for SpotMe and Mobile Check Deposit

- To qualify for SpotMe overdraft protection۔

- Make one direct deposit of $200 or more per month.

To use mobile check deposit:

- Make qualifying direct deposits.

- Cash Deposits

- You can deposit cash at any Walgreens vicinity, supplying a convenient alternative to traditional bank branches.

Additional Information

- Account Opening Bonus: None.

- Minimum Opening Deposit: None.

- Monthly Fees: No monthly renovation or overdraft prices.

- APY (Annual Percentage Yield): None.

- Overdraft Limit: Up to 200$ for certified clients.

- Early Direct Deposit: Access your paycheck up to 2 days early.

Check out our articles for more information on finding a free checking account and the best account bonuses.

Chime Savings Accounts

Chime offers an excessive-yield savings account with an annual percent yield (APY) of up to 2%. While this rate is competitive, a few other online banks offer better prices. However, Chime’s financial savings account comes with numerous blessings:

- No minimal deposit requirements: You can open and keep the account without needing a particular amount of money.

- No month-to-month upkeep fees: You may not be charged only for having the account.

- Chime also offers two automated savings gear that will help you shop extra without difficulty.

- Overspending cash: spending cash through your Chime card would make it purchase a dollar higher than needed, thus, depositing the cents to your Chime savings account.

- When I receive money: My system will automatically move 10% of all direct deposits over $500 to my savings account.

To open a Chime financial savings account, you first need to open a Chime bank account. Once you have got both money owed, you can hyperlink them and use those computerized capabilities to assist develop your savings.

For greater information on the exceptional savings money owed, you can check out our article on pinnacle high-yield savings debts.

Savings Account Features

- Account Opening Bonus: There is no bonus for commencing a financial savings account.

- Minimum Opening Deposit: You do not want to deposit any money to open an account.

- Monthly Fees: There are no monthly renovation prices.

- Top APY (Annual Percentage Yield): You can earn up to 2.00% hobby for your savings.

- Monthly Transaction Limit: You can make up to six transactions in line with the month.

Chime Credit Card Explained

It gives a unique form of credit card referred to as the Credit Builder Secure Visa. It’s intended to help people begin building their credit without charging any month-to-month prices, hobbies, or needing a credit check to apply. Plus, you don’t need to be positioned down a minimum protection deposit.

Here’s how it works:

- Transfer Money: Move money from your Chime checking account to your Credit Builder account.

- Use Like Normal: Once you have transferred money, you can use your Credit Builder card similar to every other Visa card, anywhere Visa is conventional.

- Pay Monthly: Make sure to repay your monthly stability on time for the usage of the money you transferred. This allows build your credit score score.

Chime keeps track of your credit records and reports it to the predominant credit bureaus. But to get this card, you’ll want to open a Chime bank account and have at least $200 in qualifying month-to-month direct deposits. Also, there may be a restriction on how a great deal you spend every month identical to the cash you transferred.

In this manner, you can begin constructing your credit score responsibly and without worrying about greater prices or excessive interest rates.

Is Chime Secure?

Chime takes your security seriously. Here’s why you can trust them:

- FDIC Insured: Chime and its accomplice banks are members of the FDIC, because of this your deposits are included by way of the authorities for up to $250,000.

- Robust Security Measures: Chime makes use of industry-diagnosed technology and safety frameworks to hold your records secure. They have more than 4,000 customer support experts available 24/7 for help.

- Visa Zero Liability Policy: Chime cards come with Visa’s Zero Liability Policy, which means that you might not be held answerable for unauthorized costs made along with your card.

- Custom Account Alerts: You can set up alerts in your account to maintain song of your transactions and be notified of any unusual interest.

- Identity Verification: Chime gives identity verification to feature a further layer of protection in your bills.

- Card Blocking: If your card is lost or you have any suspicious hobby, you can speedy block your card via the Chime app to prevent unauthorized use.

With these safety features in place, Chime works tough to ensure your peace of thoughts at the same time as using their platform.

Chime Fees

Chime continues to expense easily and coffee compared to conventional banks. Here’s what you might not fear approximately with Chime:

- No minimal balance fees: You do not need to maintain a positive sum of money in your account.

- No month-to-month charges: You won’t be charged only for having an account each month.

- No preservation expenses: There’s no fee for the preservation of your account.

- No direct deposit charges: You can deposit your paycheck at once into your account without spending a dime.

- No overdraft charges: If you spend more money than you have got, you won’t be hit with a charge.

However, there’s one price to be aware of: Chime charges a $2.50 fee for ATM withdrawals if you use an out-of-network system. The ATM operator might also price an additional price.

Pros:

- Automated savings tools

- Easy online banking experience

- Build credit with no credit check or fees

- Access to over 60,000 fee-free ATMs

Cons:

- The checking account doesn’t offer interest

- Does now not provide money market bills or certificates of deposit (CDs)

- No physical branches available

- Mobile check deposit is only available with qualifying direct deposit

Comparing the Chime Bank Mobile App with Other Apps

If you’re exploring online banking alternatives, it is crucial to compare what exceptional banks offer via their cell apps. Here’s how Chime stacks up towards 3 different popular online banking apps: Ally, Varo, and SoFi.

Chime vs. Ally

Banking Products:

- Chime offers a simple menu of banking offerings which includes a bank account and savings account with a debit card.

- Ally has a full suite of banking products together with interest-bearing checking money owed plus savings debts with credit score playing cards; however, it additionally offers cash market debts as well as CDs of high yield, Raise Your Rate or no penalty range.

Features and Fees:

- Chime: You won’t be charged any fees needed to maintain a balance or incur overdraft fees. Offers automated savings tools.

- Ally: No month-to-month preservation costs or minimum balance necessities. Provides up to four.20% APY on financial savings money owed and reimburses up to $10 in foreign ATM prices in step with the announcement cycle.

Additional Services:

- Chime: Focuses on ease of use with daily balance notifications and transaction alerts.

- Ally: In addition to deposit accounts, gives loans, mortgages, investment money owed, and a coins-again credit card.

Chime vs. Varo

Banking Products:

- Chime: Basic offerings with an emphasis on ease of use and fee-unfastened transactions.

- Varo: Varo offers bank accounts (checking) and Varo savings accounts.

Features and Fees:

- Chime: No month-to-month costs, minimal stability necessities, or overdraft expenses. Provides rate-unfastened ATMs get entry to to 60,000 machines.

- Varo: No monthly or overdraft prices. Access to 55,000 price-unfastened ATMs. Varo Advance allows for paycheck advances up to $500.

Additional Services:

- Chime: Enables daily balance notifications and transaction alerts.

- Varo: Offers Varo Believe for credit building with no security deposit, fees, or interest.

Chime vs. SoFi

Banking Products:

- Chime: Basic checking and savings accounts.

- SoFi: Comprehensive variety along with interest-bearing checking and savings accounts, private loans, mortgages, scholar loans, refinancing, small commercial enterprise financing, estate planning, and coverage.

Features and Fees:

- Chime: No monthly expenses, minimal stability requirements, or overdraft expenses. Offers automatic financial savings and direct deposit up to two days early.

- SoFi: Offers above-average APYs on savings and checking accounts with direct deposit. No account or foreign transaction fees. Provides cash back at select retailers and a generous sign-up bonus.

Additional Services:

- Chime: Daily balance notifications and transaction alerts.

- SoFi: A chartered bank that offers competitive lending rates and higher yields on savings and checking. Also offers a broader range of financial services.

Related App: CitiBank Mobile App

Summary

The Chime Bank mobile app is good for the ones beginning their economic adventure, providing a person-pleasant app with important banking offerings and no hidden expenses. However, if you want extra comprehensive banking offerings, Ally and SoFi provide a broader range of products, consisting of loans and investment money owed. Varo is another solid alternative, particularly for those interested in paycheck advances and credit-building options without fees. Each app has unique features, so choosing the best one depends on your specific banking needs and preferences.

FAQs About Chime

1. Can Chime be trusted?

Certainly, Chime is considered a bank, with the assurance of FDIC coverage of, up to $250,000. Both of its partner banks are also FDIC members. Chime is recognized for its industry-standard technologies and security measures, with over 4,000 customer service experts available 24/7.

2. What is the downside of Chime?

Chime doesn’t offer CDs or money market accounts. It provides only basic checking and savings accounts. Cash deposits are limited to Walgreens locations. While its savings account offers a competitive APY of 2.00%, it may be lower than other online banking options. Chime’s credit-building credit card has limited benefits.

3. What is the upside of Chime?

Chime is a financial technology agency that gives computerized financial savings gear and a credit card designed that help you build a credit score. Its savings gear assists you in rounding up debit card purchases to the closest dollar and transferring that amount to your savings account. Additionally, you can opt to circulate 10% of qualifying direct deposits from your checking on your savings account.

4. Does Chime build credit?

Yes, Chime gives a Credit Builder Secure Visa credit card to help customers build credit scores. This card can be used anywhere Visa is regularly occurring, and Chime reviews your credit history to major credit score bureaus. However, to use the card, you need to open a bank account and switch cash into your credit score account every month.