The Green Dot Mobile Banking App offers a comprehensive answer for dealing with your finances on the cross. With capabilities like clean deposits, cash transfers, and bill bills, the app presents a convenient right of entry to your financial institution bills 24/7. Users can enjoy the Cash Back Bank Account, which offers coins returned on purchases, free coin deposits, and loose ATM withdrawals. Recognized as one of Newsweek’s Most Trustworthy Companies in America for 2023, Green Dot has managed over 67 million bills to date. The app is available on the Apple App Store and Google Play, ensuring an unbroken banking revel in for all users.

Green Dot App Features:

- Slide for Balance: Check your account balance with a quick swipe.

- Account History: View your balance, transaction history, and account info anytime, anywhere.

- Send Money: Easily switch money to everybody with a Green Dot account.

- Mobile Deposit: Deposit tests into your account the usage of your cellphone.

- Lock/Unlock Card: Temporarily lock your card in case you misplace it to prevent new purchases.

- Money Vault: Set aside money for savings or special goals.

- Overdraft Protection: Cover checks or debits larger than your balance and get push notifications for overdraft protection.

- Customer Support: Access chat support through the app to quickly resolve issues.

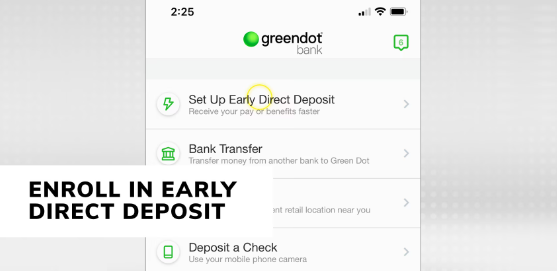

Get Your Paycheck Faster with Easy Direct Deposit

- Get Your Money Early: Deposit your paycheck or authorities’ blessings directly into your account to get paid up to 2 days early and benefits up to four days early.

- Overdraft Protection: You can get overdraft safety for as much as $200 while you choose-in and feature eligible direct deposits.

- Stay Informed: Receive notifications when your direct deposit arrives.

- Free and Easy: Enrolling in direct deposit is free, and there are no fees for deposits.

how to enroll in direct deposit:

- Get Your Bank Info: Text DD to 42586 or log into your account to find your bank account number (standard message and data rates may apply).

- Fill Out the Form: Enter your name and Green Dot account number in the provided form. Make sure your name and Social Security number match what your employer or benefits provider has on file.

- Choose Deposit Amount: Decide how lots of your paycheck you need to deposit into your Green Dot account.

- Authorize and Submit: Sign and date the form, then post it on your commercial enterprise business enterprise or benefits enterprise.

Tip: Ask your employer or benefits provider how long it will take to set up your direct deposit. If it takes longer than expected, check back with them for updates. Green Dot does not have information about your enrollment status.

Read: Dave Mobile Banking App

5 Easy Ways to Deposit Money

1. Deposit Cash

Need to add cash to your account while you’re out? There are two convenient ways:

- Use your Green Dot card at over 90,000 locations. Just provide your cash to the cashier, and they’ll swipe your card and your cash can be delivered routinely. A rate of up to $4.95 applies.

- Use the Green Dot app. Generate a secure barcode, give your

cash and the code to the cashier, and your money will be added automatically.

2. Bank Transfer

Transfer money from another bank to your Green Dot account easily.

- Just log in to your account on the app or GreenDot.com, select Deposit, then Bank Transfer.

- Manage transfers online without going to the bank, and your money will be transferred within 3 business days.

- Plus, Green Dot doesn’t charge a fee for this service!

3. MoneyPak

MoneyPak is an easy way to send cash to almost anybody. It’s perfect for masking sudden expenses, repaying IOUs, or giving a loved one a present they may recognize.

How It Works:

- Buy a MoneyPak: Purchase a MoneyPak at thousands of outlets throughout the United States of America.

- Create a Secure Login: If it’s your first time the usage of MoneyPak, create a stable login at MoneyPak.com.

- Add Funds: Use the secure MoneyPak number to feature up to $500 coins to any eligible debit or prepaid card on MoneyPak.com. Check-in case your card is eligible in advance.

Key Benefits:

- Quick and Convenient: Easily ship cash within minutes, every time you need it.

- Widely Accepted: MoneyPak works with most Visa®, Mastercard®, and Discover® cards and over two hundred prepaid debit card manufacturers.

- Accessible Everywhere: MoneyPak is to be had at outlets national, making it clean to locate one near you.

4. Easy Check Cashing with MoneyPak and Ingo® Money App

Cash Checks with MoneyPak:

- Buy a MoneyPak from many retailers.

- First-time users make a secure login at MoneyPak.com.

- Use the MoneyPak number to add funds to eligible cards at MoneyPak.com.

Cash Checks with Ingo® Money App:

- Download the Ingo® Money App on your smartphone.

- Create your profile and link your Green Dot card.

- Follow the steps to photograph your check.

- Receive your money in minutes for a fee or within 10 days for no fee.

Deposit Checks with the Green Dot App:

- Deposit paychecks, government, and personal checks with the Green Dot app.

- Get your money quickly.

Why Choose Ingo® Money:

- Quickly cash government, paychecks, and personal checks.

- The app is to be had on iOS and Android.

- Access cash in minutes for a rate or inside 10 days for no fee.

- Use promo code Gdot5 for a $5 credit on fees.

Must Read: Chime Bank Mobile App

5. Depositing Money at Walmart with Green Dot:

At Walmart, you can conveniently cash checks and deposit money onto your Green Dot card. Here’s how it works:

Cash Checks and Deposits:

- Use your Green Dot card to cash checks and make deposits in-keep at Walmart.

- You can cash exams up to $1,000.

- For a $3.74 retail carrier rate, you may deposit the cash onto your Green Dot card, allowing you to keep and make purchases quickly.

Cashing Checks at Walmart:

- Bring your preprinted exams (like payroll or government exams) and Green Dot playing cards to any Walmart sign-up.

- You can coin tests as much as $1,000, with a charge of $4.

Deposit Process:

- Deposit up to $1,000 onto your Green Dot card for a $3.74 retail provider fee.

- Typically, the deposited money becomes available for your card within 10 minutes.

- Your receipt serves as proof of your deposit.

Load and Availability Limits:

- Refer to the information below for details on load and availability limits.

This way, you can manage your money conveniently and access it when needed, all at Walmart with your Green Dot card.

4 Strategies to Manage & Move Your Money

Person-to-Person Transfers:

- Send money to another Green Dot account holder.

- Convenient and easy transfer to anyone in the U.S. with a Green Dot account.

- Fast access to the received money for your family and friends.

- There are no costs for transfers to different Green Dot accounts.

- It is a simple process with the use of the recipient’s cellular wide variety of e-mails.

Mobile Wallets:

- Add your Green Dot card to Apple Pay®, Google Pay™, or Samsung Pay®.

- Make purchases swiftly using your mobile device instead of a physical card.

- Convenient for both in-store and online shopping.

- Saves time with quick payment options directly from your phone.

Order Personalized Checks:

- Easily order paper checks for various purposes like expenses or gifting.

- Order 12 checks for $5.95 with no additional shipping charges.

- Payment is deducted from your balance upon ordering.

- Checks are delivered within 2 weeks.

MoneyPak®:

- Quickly send cash to almost anyone.

- Deposit up to $500 cash to eligible debit or prepaid cards within minutes.

- Widely accepted across major card brands and over 200 prepaid debit card brands.

- Conveniently available at retailers nationwide.

- Simple process involving purchasing a MoneyPak, creating a secure login, and adding funds to the desired card online.

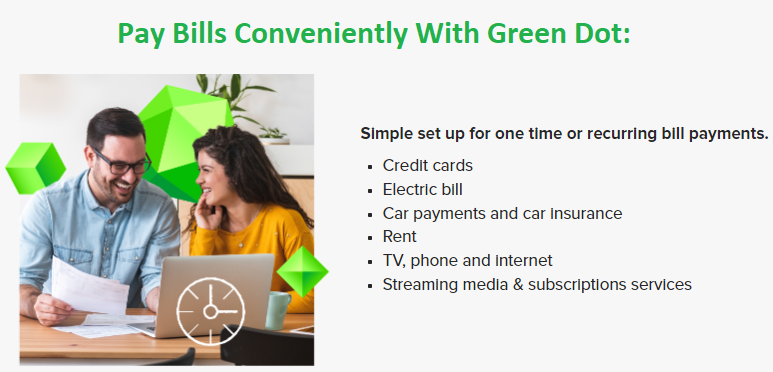

Pay Bills Conveniently With Green Dot:

Save time and manage your finances efficiently with our bill payment options. Use our Online Bill Pay Service to set up bill payments anytime, or pay your credit card bill on the go at a nearby retailer.

3 Easy Ways to Pay Bills:

- Online: Use our Online Bill Pay Service to set up and manage bill payments anytime.

- At a Store: Pay your bills at participating retailers near you.

- At a Financial Service Center: Pay bills conveniently at financial service centers.

Unlock Overdraft Protection Up to $200 with Green Dot:

Set up qualified direct deposits and opt-in to be covered for all purchases.

Did You Know?

- Most banks charge an average of $34-$35 per overdraft.

- Green Dot’s overdraft fee is, on average, half of what other banks charge.

- Most Green Dot customers don’t pay a fee as they repay the overdraft within 24 hours.

How It Works:

Set Up Direct Deposit:

- Follow the quick help guide to set up direct deposit in a few simple steps.

Opt-In for Overdraft Protection:

- After putting in direct deposit, comply with the instructions to decide.

- Ensure you meet the direct deposit eligibility necessities before opting in.

Coverage Details:

- Coverage depends on your direct deposits, overdraft pastime, and account status.

- You have 24 hours to deliver your stability to as a minimum $0 to keep away from a charge.

Also Read: Varo Bank Mobile App

How to Access Green Dot on iOS 14, Android, and Windows 10:

- To use the Green Dot banking app on your device, follow these steps:

Download and Install:

- Go to the Google Play Store for Android or the Apple App Store for iOS.

- Search for the Green Dot app and download it.

Find the App:

- Once installed, you can find the Green Dot app in your device’s “Installed apps” section.

Compatibility:

- The Green Dot app works on Android devices with model 4.4 or later.

- For iOS gadgets, it works on iOS 9.0 or later.

- It is also like-minded with watchOS 2.0 or later.

How to Download the Green Dot Mobile Banking App

- Open the App Store: Open the Apple App Store on iOS gadgets or Google Play Store on Android gadgets.

- Search for Green Dot: In the quest bar, kind “Green Dot Mobile Banking App.”

- Select the App: Find the official Green Dot app in the search results.

- Download the App: Click the “Download” or “Install” button.

- Install the App: Wait for the app to download and automatically install on your device.

Login to the Green Dot Mobile Banking App

- Open the App: Tap on the Green Dot app icon on your device.

- Enter Login Details: Input your User ID and Password.

- Sign In: Tap the “Sign In” button to access your account.

How to Reset Password on the Green Dot Bank App

- Open the App: Launch the Green Dot app for your tool.

- Go to Login Screen: On the login screen, faucet on “Forgot login data?”

- Enter Required Information: Provide the necessary information which includes your User ID or electronic mail.

- Follow Instructions: Follow the on-display screen instructions to reset your password.

- Create a New Password: Once induced, input a brand new password and verify it.

- Login: Use your new password to log in to the app.

More Read: CitiBank Mobile App

Conclusion

The Green Dot Mobile Banking App is a strong economic device that simplifies cash management. Offering functions like direct deposit, invoice pay, and cell check deposits, it caters to a wide variety of banking desires with comfort and protection. Users gain from real-time transaction alerts, spending insights, and a person-pleasant interface, enhancing their financial control. The app’s accessibility and comprehensive services make it a treasured asset for all people seeking green and modern banking solutions. In a digital age, the Green Dot Mobile Banking App sticks out as a reliable and versatile preference for coping with non-public price ranges.

FAQs

1. Why did my card get declined?

Transactions may be declined for numerous reasons:

- The card is no longer activated

- Card expired

- Card locked

- Exceeded spending limits

- Incorrect PIN entered a couple of times

- Insufficient price range

- Unusual transaction styles

- Violation of Account Agreement terms

If problems persist, affirm your card is activated and funded, then use the Green Dot app’s Settings, Get Help, or Chat functions on GreenDot.Com.

2. What are the fees and limits?

Log in to look at your Account Agreement for expenses and bounds associated with your card which include each day and monthly withdrawal limits. Fees can be observed inside the “Fees” phase, at the same time as limits can be determined within the “Limits on Your Account” section.

3. How do I check my card balance and transactions?

Check your stability and transaction history anytime at GreenDot.Com or through the mobile app. Add your mobile-wide variety in Account Settings to use text instructions: textual content “BAL Last4” or “HIST Last4” to 42586 (Last4 = last 4 digits of your card). Carrier message charges may also be observed. For the maximum correct balance, use the internet site or app.

4. How do I close my account?

To close your Green Dot account, login at GreenDot.Com and visit Security, Close your Account, or use the Green Dot app and visit Settings, Manage Card, and Close your Account. Choose from the following options:

- Use my balance: Spend your stability to $0 with your card to mechanically close your account.

- Get coins now: If your stability is at least $22.50, use a barcode in your smartphone to select up cash at Walmart, with a carrier rate of $2.50 – $5.00. This will robotically close your account.

- Get a reimbursement test: Verify your mailing address, pick out near account, and get a refund test, for you to be sent within 14 days, and your account will be automatically closed.

After last, you may nonetheless view statements and transaction records at GreenDot.Com, but you may not have app access. For assistance, contact Customer Support at (866) 795-7597.

5. How do I reset my password?

Click here to reset your password on GreenDot.Com. Or click on Forgot login information on the Green Dot app login display screen. You’ll want your Social Security Number, 16-digit card range, and protection code (CVV) to reset your password.