Embark on an adventure of discovery and mastery with our comprehensive manual to swing trading techniques, tailor-made specifically for novices. In this dynamic landscape of marketplace fluctuations, knowing a manner to successfully capitalize on a brief to medium-term developments is paramount. Our guide offers a curated choice of swing trading techniques, every meticulously designed to equip you with the abilities and insights needed to navigate the complexities of shopping for and promoting globally.

From fashion identity to risk control strategies, we delve into the fundamentals with clarity and precision, ensuring you grasp the requirements for achievement. Whether you’re taking your first steps into buying and promoting or on the lookout for refining your approach, this manual presents the roadmap you need to thrive inside the thrilling realm of swing trading.

Swing Trading Techniques

What is Swing Trading?

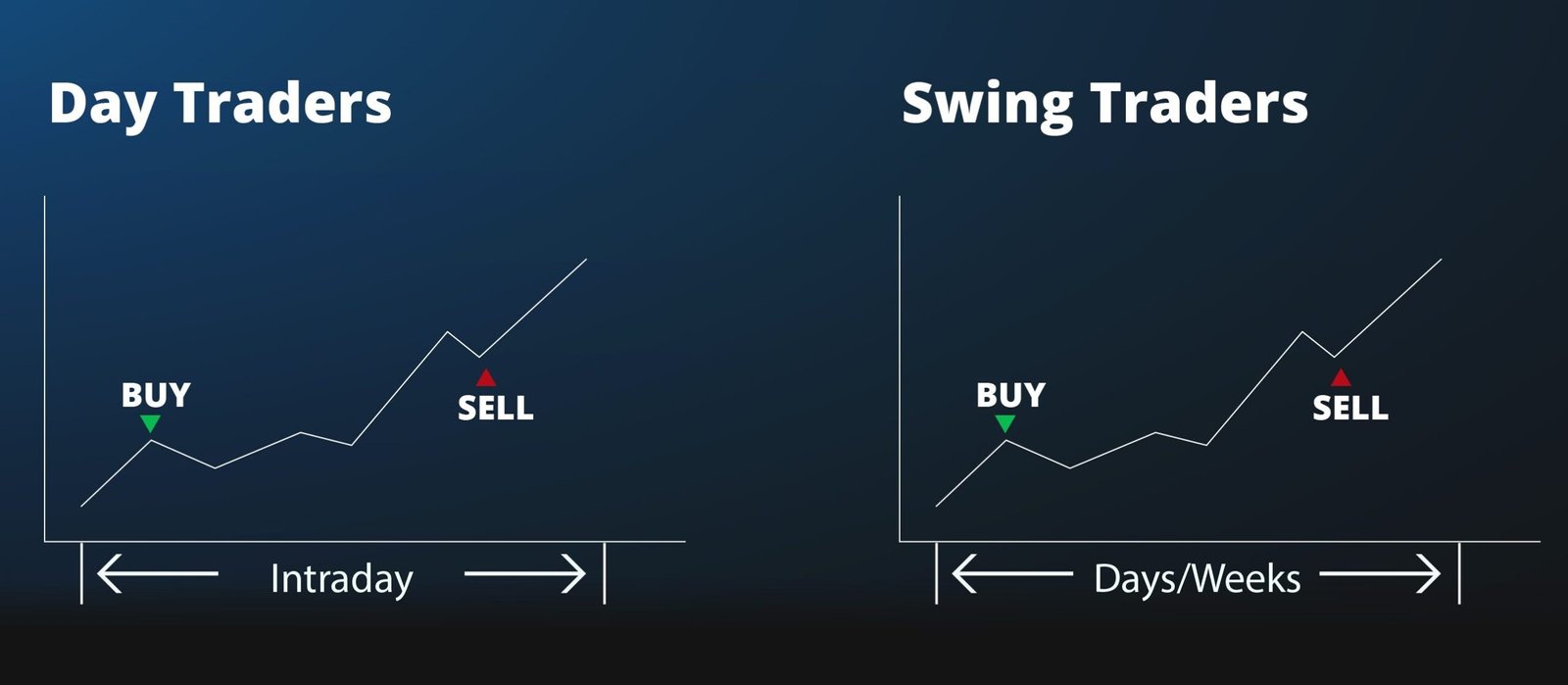

Swing trading is a form of shopping for and promoting where buyers goal to make profits from rate movements over a medium-term length. Unlike day buying and selling, where trades are accomplished within a single day, or position buying and selling, in which trades are held for weeks or months, swing buying and promoting commonly involve maintaining trades for numerous days to weeks.

Key Concepts in Swing Trading

Swing trading revolves around identifying developments and taking pictures of swings within one’s trends. These swings consist of components: the swing frame and the swing factor. While the intention is to seize the bulk of each swing body, trying to time the precise swing point may be risky and result in losses.

Strategies in Swing Trading

Swing investors use numerous strategies, including essential and technical evaluation, to count on whether or not or no longer an asset’s price will upward thrust or fall. The purpose is to enter trades whilst there can be an excessive opportunity for fulfillment, together with looking for at swing lows during uptrends or promoting at swing highs during downtrends.

Patience and Risk Management

Swing buying and selling calls for persistence, as trades are held longer than day trades, and it is commonplace for expenses to range for the duration of the retaining length. To control danger, investors must use large prevent losses to withstand volatility. Staying calm at some point of price fluctuations and trusting one’s technical evaluation is vital for success.

Considerations for Swing Trading

Since trades last longer, spreads and liquidity have less impact on earnings. This allows traders to recollect belongings with large spreads and decrease liquidity. However, attention has to be paid to switch factors, and traders need to adapt their cash control plans accordingly.

Must Read: 8 Tips For Investing in Penny Stocks

Types of Swing Trading Techniques

Swing trading includes numerous strategies to benefit from brief- to medium-term charge movements. Here are 4 famous techniques:

- Reversal Trading: These Techniques are predicated on identifying shifts in price momentum, indicating a change within the trend path. Reversals may be either high-quality (bullish) or negative (bearish), however, they may be elaborate to distinguish from short-time period pullbacks, which are transient reversals within a current fashion.

- Retracement Trading: Retracement trading involves in search for brief reversals in a bigger fashion. These retracements, additionally called pullbacks, arise when charges in the brief flow toward the primary trend before continuing in the authentic course. It’s important to differentiate between a retracement and a complete fashion reversal.

- Breakout Trading: In breakout buying and selling, investors intend to go into positions early in an uptrend whilst expenses are destroyed through key resistance levels. These techniques include figuring out capability breakout points and coming into positions as quickly as the breakout takes place.

- Breakdown Trading: Similarly to breakout buying and selling, breakdown buying and selling includes entering positions early in a downtrend when expenses break via key help stages. Traders screen for capability breakdowns and act swiftly to capitalize on the downward momentum.

These techniques offer one-of-a-kind methods to method swing trading, each with its advantages and challenges. As with any buying and selling method, it’s critical to thoroughly recognize the approach and practice danger control to minimize capacity losses.

Swing Trading VS. Day Trading

When it involves making short income in the inventory marketplace, swing trading and day trading are famous techniques, however, they have some key variations.

- Day Trading: The Day investor’s goal is to buy and sell shares within very quick timeframes, regularly just seconds or minutes. They may make many trades in a single day, aiming for a small income each time. Sometimes they could maintain a stock for a few hours if there may be massive news affecting its price.

- Market Analysis in Day Trading: Day traders are not aware of a good deal of long-term period trends or massive financial elements. Instead, they use technical evaluation to identify tiny shifts in supply and demand that can appear in the day. Even though these shifts might appear random, day traders believe they can predict them.

- Swing Trading: Swing traders take a distinct approach. They look to make earnings from larger charge actions which could take days or perhaps weeks to manifest. These actions regularly come from the most important information or changes inside the average marketplace sentiment.

- Market Analysis in Swing Trading: Unlike day traders, swing investors are aware of the bigger image. They have a look at essential factors like business enterprise income or economic tendencies to manual their trades. Technical analysis nevertheless plays a role, however, it’s greater approximately confirming their fundamental outlook.

Both strategies have their professionals and cons, so it’s essential to understand them before diving in.

Comparing Swing Trading with Long-Term Position Trading

Swing trading and lengthy-time period role buying and selling occupy a middle ground between day buying and selling and lengthy-term investing. While swing buyers aim for quick-term gains over days or weeks, position buyers, similar to investors, maintain onto property for weeks to months.

Position traders verify the market’s long-term trajectory, focusing on the broader financial panorama to tell their choices. They purpose to understand the bigger image and are expecting massive-scale traits to seize capacity returns. As time progresses, charges range in the standard fashion. Position investors often navigate through those smaller fluctuations, while swing buyers are more inclined to exploit these shorter swings.

Understanding Risks in Swing Trading

Trading Frequency and Risk:

Swing buying and selling regularly entails more frequent trades in comparison to lengthy-time period strategies. However, this accelerated frequency also way extra publicity to risks. If you are no longer confident in dealing with those risks, it’s recommended to start slowly to gauge their impact on your trading capital. Additionally, common buying and selling incurs higher transaction costs, that can decrease universal returns, notwithstanding the profitability of your swing buying and selling approach.

Trading Complexity and Risk:

Each trading opportunity in swing buying and selling provides a unique market situation, main to various approaches. This variability provides complexity, increasing the risk of misreading the marketplace or making execution errors.

Advantages and Disadvantages of Swing Trading

Swing buyers make choices primarily based on the balance between risk and potential reward. They observe asset charts to pinpoint access points, set stop-loss orders and are expecting where they could exit with earnings. For example, if they’re willing to threaten $1 in line with proportion for an ability $3 advantage, it’s taken into consideration a positive risk/reward ratio. Conversely, aiming for just a $0.75 benefit with an equal $1 hazard isn’t always as attractive.

These traders closely rely upon technical analysis because of the fast-term nature of their trades. However, they will comprise fundamental analysis to validate their techniques. For example, if they spot a bullish setup, they might test if the asset’s basics help or are improving the outlook.

Swing buyers usually recognize everyday charts but may also study hourly or 15-minute charts for precise access, forestall loss, and take-income factors.

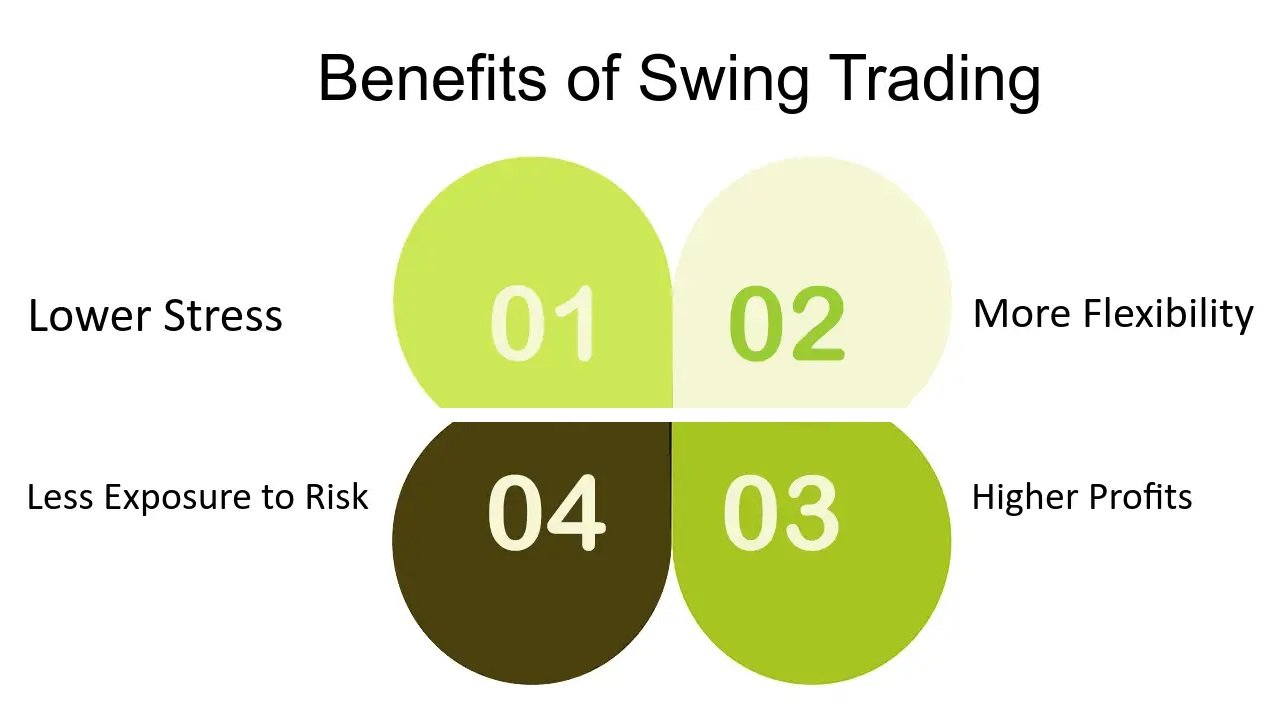

Benefits of Swing Trading Techniques:

- Swing buying and selling is a fashion of trading that suits those with complete-time jobs or limited time for everyday buying and selling activities. Unlike day buying and selling, which needs consistent interest, swing trading moves at a slower pace, allowing buyers to control it alongside their different commitments.

- With swing trading, you may set wider stop-loss orders, lowering the chance of positions lasting prematurely. This approach gives a buffer against sudden marketplace fluctuations and potential losses.

- Unlike day buying and selling, where buyers need to live glued to their monitors for hours, swing trading requires less screen time and emotional energy. This makes it more reachable to folks who can’t commit extended intervals to buying and selling every day.

- One of the benefits of swing trading is its capability for higher returns by maintaining positions for longer durations. This approach can make better use of capital compared to day-by-day buying and selling, wherein new positions are opened and closed frequently. However, buyers need to think about keeping fees whilst opting for this approach.

Drawbacks of Swing Trading:

- To succeed in swing trading, investors need to comprehend technical analysis to pinpoint while to enter and go out trades. This skill is probably a 2d nature for pro investors, but novices might require extra practice studying charge charts.

- Since swing trades are frequently held on a single day or for several nights, there is a danger of “gapping,” where the price jumps overnight due to diverse monetary signs.

- While maintaining positions for longer durations can result in bigger income, it also will increase the capability for large losses, especially with the use of leverage.

- Swing trading needs patience and may nonetheless be worrying if a change starts offevolved moving against expectancies.

Choosing the Right Swing Trading Techniques

When it involves deciding on the right swing trading approach, it is critical to understand that there isn’t always a one-size-suits-all answer. The method you choose will in large part rely on your revel in, risk tolerance, and private options. Since markets are constantly evolving, you may want to tweak your techniques through the years if it is now not yielding favored outcomes or if your choices change.

To find the high-quality swing trading method for you, observe the steps:

- Understand Your Trading Style: Swing buying and selling encompasses various patterns, so it’s important to discover which fits you pleasant. If you’re comfortable maintaining positions for only some days, you may choose a countertrend method, aiming to take advantage of smaller charge reversals. Conversely, if you’re pressed for time, a trend-following method, which entails holding positions for numerous weeks, is probably greater appropriate.

- Educate Yourself: Continuously investing in mastering is important, even if you accept it as true once you’ve discovered the closing techniques. Education is the key to evolving as a dealer and staying ahead in the markets.

- Testing: Utilize a demo account to experiment with new techniques or adjustments in your present one. This affords secure surroundings to assess their effectiveness before implementing them with actual money.

Conclusion

Mastering swing trading techniques, discipline, and non-stop mastering. The techniques explored in this manual offer novices a solid basis to navigate the dynamic landscape of swing trading. Aspiring traders can enhance their probabilities of fulfillment by know-how market tendencies, setting clean entry and exit points, coping with threats efficiently, making use of technical analysis equipment, and staying knowledgeable approximately marketplace information. However, it is essential to recall that no strategy guarantees income, and losses are inevitable in buying and selling. Patience, perseverance, and flexibility are key virtues to domesticate along the adventure. With dedication and practice, novices can gradually construct the abilities necessary to thrive within the exciting world of swing buying and selling.

FAQs

1. How long should you hold a swing trade?

The conserving duration for an average swing trade falls somewhere between days and two weeks. Of course, there are exceptions wherein some trades are held for longer intervals of time – however, we’re going to communicate approximately that in a while. For now, let’s focus on the average preserving period for a swing trade.

2. What is the best time frame for swing trading?

The nice time frame for swing trading, if you have simply commenced investing, is between 6 months to one year. Technical evaluation is the tool that is regularly used to pick an inventory and carry out trades. The evaluation of shares gives you a perception of when to shop for the inventory and when to move short on the inventory.

3. Do swing traders trade every day?

The number one distinction inside the trading techniques is that day buyers trade many shares for the duration of a day, even as swing traders exchange many stocks over an extended time frame, normally days to 3 weeks.