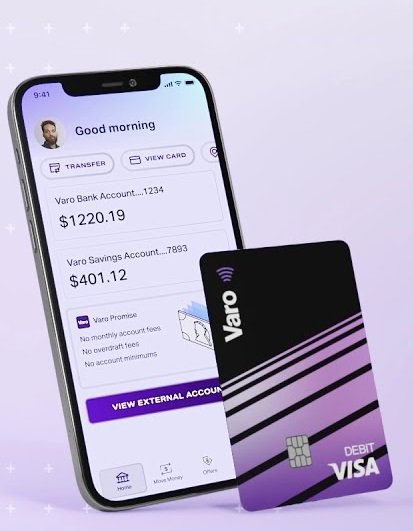

Since its inception in 2017, the Varo Bank Mobile App has been at the vanguard of virtual banking innovation. Developed to satisfy the evolving wishes of present-day customers, it gives seamless get admission to financial services each time, anywhere. With capabilities like cellular test deposit, budgeting tools, and early direct deposit, Varo has transformed the way people manage their money. Its user-pleasant interface and commitment to financial inclusion have earned Varo recognition as a pioneer inside the fintech enterprise, shaping the destiny of banking.

Varo Bank Mobile App

Unlock a global of monetary freedom with the Varo Bank mobile app. Whether you’re budgeting, saving, or building a credit score, Varo has given you included with its complete suite of functions. Here’s an overview of what to expect.

All-in-One Financial Management

Own your money lifestyles with Varo’s all-encompassing platform. From primary banking to credit score-building gear, the entirety you want is without difficulty on hand inside the Varo Bank mobile app.

Real-Time Money Tracking

Stay knowledgeable approximately your budget with actual-time transaction indicators and stability updates. With Varo, you’ll in no way pass over a beat, as you will obtain notifications for each card swipe, deposit, or withdrawal.

Lightning-Fast Payments

Send and acquire money simply through the use of Zelle® directly via the Varo Bank mobile app. Whether it is paying returned a pal or splitting payments, Varo ensures seamless man or woman-to-character transactions.

Credit Health Monitoring

Monitor your credit rating effects inside the Varo Bank mobile app. Keep tabs on your credit score fitness with no effect on your score, all at your fingertips and free from the rate.

Varo Bank: Your Ultimate Money Partner

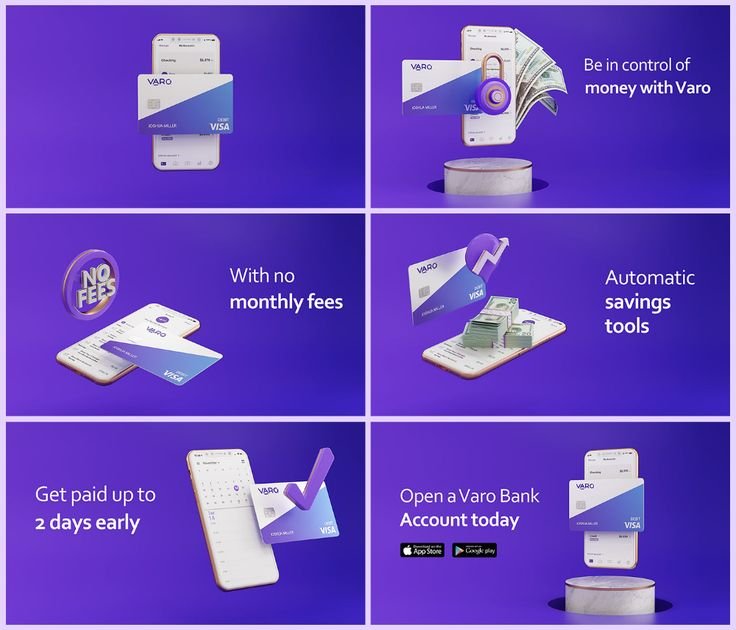

Are you tired of your tough-earned money being eaten up by using fees? Do you need to manipulate your price range and reach your money desires quickly? Look no further than the Varo Bank banking revolution designed to make your cash work tougher for you.

Early Payday

Say goodbye to anticipating your paycheck to clean. With Varo Bank, you can receive a commission up to 2 days early, supplying you with the liberty to access your money when you need it most.

No Hidden Fees

At Varo Bank, transparency is key. We believe in maintaining your cash in which it belongs—in your pocket. That’s why we do not charge any monthly costs, overdraft fees, or the pesky “WTF” costs. With Varo Bank, what you spot is what you get.

Instant Access

Need coins rapid? With over forty,000 charge-free ATMs nationwide, Varo Bank makes it smooth to get admission to your cash whenever and anywhere you want it. No greater scrambling to discover a financial institution department or pay useless costs.

Must Read: GTworld Mobile App

Send Money with Zelle®

Need to break up the invoice or send money to a chum? Varo Bank has you covered with Zelle® integration right in our app. Send and receive cash with just a few faucets, all without leaving the consolation of your Varo Bank account.

Cashback Rewards

Everyone enjoys a bit of money, right? Varo Bank offers cashback incentives, for your purchases giving you savings to enjoy.

FDIC Insurance

Feel assured that your finances are, in the hands of Varo Bank. Being a trusted bank we are covered by FDIC insurance for amounts, up to $250,000 ensuring that your money is safeguarded and giving you peace of mind.

One App for It All

Streamline your situation, with the Varo Bank app that offers a range of features. From budget management tools to monitoring your expenses all the resources required to handle your finances are conveniently accessible, through this app.

Online savings account

Varo Bank provides an internet-based savings account designed to assist you in increasing your funds with ease. Here is a summary of the information you should be aware of;

Zero Fees, High Returns

Varo Banks savings account doesn’t have any fees so you can save without being concerned about charges reducing your savings. Additionally, their automatic savings tools allow you to see your money increase effortlessly.

Earn Up to 5.00% Annual Percentage Yield (APY)

Varo Banks savings account stands out for its feature of an APY. By maintaining balances, up to $5,000, you have the opportunity to earn a 5.00% APY, which can accelerate your progress, toward achieving your savings targets.

Automatic Round-Ups for Easy Saving

Varo Bank makes saving simple with automatic round-ups. Whether it’s a little from your paycheck or spare change from your transactions, these round-ups help you save effortlessly.

No Minimum Balance Requirement

Varo Banks savings account stands out from banks by not imposing any balance requirements to avoid fees. This allows you to kickstart your savings journey with any amount regardless of whether it’s big or small.

Varo Believe Credit-Builder Card

The Varo Believe Credit Builder Card offers a way to improve your credit score. With no expenses and a straightforward manner, it supports lots of people to take control of their monetary futures.

Easy to Use

The Varo Believe Card makes credit building effortless. With clear terms and a person-friendly interface, it is smooth to commence your journey to a higher credit score.

No Fees

Forget about hidden costs or surprise costs. The Varo Believe Card has no annual fees, no interest prices, and no minimal security deposit required.

Worry-Free

Say goodbye to pressure and uncertainty. With the Varo Believe Card, you may build credit without stressful about overspending or moving into debt.

Real Progress

See real results in just a few months. On average, Varo Believe Card customers experience a significant increase in their credit score after making on-time payments.

Also Read: SoFi Bank Mobile App

Real Impact: The Numbers Don’t Lie

40+ PTS Increase

Customers typically see a 42-point increase in their credit score after just 3 months of using the Varo Believe Card responsibly.

1 Month Success

Over 90% of customers with no credit score establish one within a month of using the Varo Believe Card.

Worry-Free Credit Building: How it Works

Use Your Own Money

With the Varo Believe Card, you are in control of your spending. Set your spending restriction and avoid the risk of overspending.

Credit Building for All

Whether you don’t have any credit score records or a low credit score, the Varo Believe Card is available to every person. There’s no minimum protection deposit required, making it a possible choice for those starting from scratch.

Zero Fees: Putting Your Financial Well-being First

No Interest, No Fees

Unlike traditional credit playing cards, the Varo Believe Card is designed to guide your monetary goals without any extra costs. There are not any hobby prices or annual prices to worry about.

No Credit Check

Don’t let past financial mistakes hold you back. With the Varo Believe Card, there’s no credit check required to apply, making it accessible to a wide range of individuals.

- Up to 34.49% Variable APR: Petal® 1 No Annual Fee Unsecured Credit Card

-

27.99% Variable APR: Discover it® Secured Credit Card

-

30.49% Variable APR: Capital One Platinum Secured Credit Card

There’s no better credit-building card out there.

Varo Believe card

- Any credit history accepted

- No credit score needed to qualify

- No credit checks needed to apply

- No minimum security deposit

- No interest

- No fees

- You set your credit limit

Other secured cards

- Only a good credit history accepted

- Credit score needed to qualify

- A hard credit check is needed to apply

- $200-$300 security deposit⁶

- High interest⁷

- Fees

- Bank sets your credit limit

Varo Bank Mobile App Cash Advance

Life can throw unexpected charges your way, however with Varo Advance, you’ve got a protection net to depend upon. Here’s how it works:

Instant Cash When You Need It

If you’re a Varo Bank consumer and meet the requirements, you may qualify for Varo Advance. We’ll spot you up to $250 right away, with the capability to boost it to $500 over the years.

Borrow What You Need & When You Need It

Whether it is overlaying payments, hiring, or surprising clinical costs, Varo Advance is right here to help. You can borrow the money you want and get it deposited directly into your Varo Bank Account in a remember of seconds.

Gradually Increase Your Limit

Initially, you may be eligible for a credit score restriction starting from $20 to $250. By persevering with applying Varo Bank services, borrowing responsibly, and making timely bills, you could regularly boost your restriction up to $500.

No Interest or Hidden Fees

With Varo Advance, you won’t worry about accruing your hobby or being hit with hidden prices. Borrow with self-guarantee, and know-how that you’re getting the help you want without extra expenses.

Simplified Process

Say goodbye to extended loan packages and equipped intervals. Varo Advance affords a simple and easy borrowing method so you can get entry to funds quickly and problem-loose.

Flexible Repayment Options

Repaying your Varo Advance is straightforward and flexible. Make on-time bills as you usually might, and watch your borrowing restrict develop through the years, providing you with even extra economic flexibility whilst you need it most.

Read More: Alliant Credit Union App: Best Mobile Banking App in 2024

Borrowing money shouldn’t put a strain on your finances.

When you decide to take out a loan the associated costs must be fair and transparent. If you meet the criteria our cash advance fees are clear and affordable. There won’t be any charges; what you’re informed about initially is what you’ll end up paying.

|

Borrow Amount |

You Pay |

|

$20 |

$1.60 |

|

$50 |

$4 |

|

$75 |

$6 |

|

$100 |

$8 |

|

$150 |

$12 |

|

$200 |

$16 |

|

$250 |

$20 |

|

$300 |

$24 |

|

$400 |

$32 |

| $500 |

$40 |

Fair and flexible. The way loans should be.

When you partner with Varo you have the freedom to choose how and when you wish to repay us. You have time. A 30 days. And interest? We’ve got none of that.

Getting Quick Cash with Varo Advance

Are you searching out some cash to cover expenses or get through till your subsequent paycheck? Varo Advance is here to assist! With Varo Advance you can without difficulty get the right of entry to cash advances through the Varo Bank mobile app. Here’s how it works;

Select Your Desired Amount

Simply open the Varo app and select the quantity of coins you require inside your improved restriction. Whether it is $20 or $2 hundred pick the amount that suits your needs.

Receive Your Funds

With a few taps, to your smartphone, you will receive your cash advance without delay into your Varo bank account. No more waiting in lines or dealing with paperwork-Varo makes getting cash brief and hassle-free.

Repaying is Easy

You have 30 days to repay your cash enhance. You can make payments in lots of installments as you opt for whenever is handy, for you. For delivered convenience keep in mind setting up bills out of your Varo Advance Account.

Qualifying for Varo Advance and Working Your Way Up to $500

Looking to access larger cash advances? Here’s how you can qualify and work your way up to $500 over time:

- Move Your Paycheck to Varo: Start by moving your paycheck over to your Varo bank account. This demonstrates your capacity to control your budget and makes you eligible for Varo Advance.

- Bank, Borrow, and Make On-Time Payments: Continue to use Varo Bank for your banking needs, borrow responsibly, and make sure you’re making on-time bills. This helps build your financial profile and increases your advance limit over time.

- Unlock Higher Amounts with Larger Direct Deposits: By adding $800 or more in qualifying direct deposits, you can unlock your first spot for larger cash advances. The more you deposit, the higher your advance limit becomes.

With Varo Advance, getting brief coins whilst you want them has by no means been less complicated. Say goodbye to financial strain and howdy to peace of mind with Varo Bank’s handy cash boost characteristic.

ATM Locator

Have you ever needed coins but do not know which to locate an ATM without excessive expenses? Say goodbye to ATM tension with Varo Bank’s ATM Locator function. It works like this:

Find cash in no time

With the Varo Bank ATM Finder, locating cash is a breeze. Simply enter your cope with or zip code and voila! You will see a map with more than 40,000 unfastened ATMs around the United States. You don’t should worry about distance – assume blocks, no longer miles to get coins fast.

Say no to fees

At Varo Bank, we consider that getting entry to your cash must not include a charge tag. That’s why we’ve partnered with Allpoint® ATMs throughout the United States to make sure you never pay useless ATM prices once more. Stick to our giant community of loose ATMs and you’ll have more money in your pocket.

More ATMs, more convenience

Did Varo Bank give twice as many rate-free ATMs as huge banks like Chase, Bank of America, or Wells Fargo? With more than 40,000 unfastened ATMs at your disposal, you will have two times as many options to get admission to coins without extra charges.

Cash where you shop

Forget detours whilst searching out an ATM. Varo Bank’s ATM Locator pinpoints available ATMs in convenient places, which include your favorite stores, local supermarkets, and nearby gas stations. Wherever you are, cash is simply across the corner.

High-Yield Savings Account

Are you bored with your financial savings account barely earning you any hobby? Say goodbye to measly returns and what’s up to high yields with Varo Bank’s High-Yield Savings Account. Let’s narrow down what makes this account stand out and how you can make the maximum of its amazing Annual Percentage Yield (APY).

What is a High-Yield Savings Account?

An excessive-yield savings account is sort of a normal savings account, however with one principal difference – it gives a miles higher interest fee. Instead of income pennies on your hard-earned cash, you can watch your savings grow at an extended charge.

Varo Bank’s Super High APY

Varo Bank does not just provide an excessive APY – it offers a high APY. How excessive, you ask? Well, how does as much as 5.00% Annual Percentage Yield sound? That’s right, with Varo Bank, you’ve got the potential to earn a whopping 5.00% APY on balances as much as $5,000 and 3.00% APY on the rest.

Qualifying for the High APY

Now, you might be wondering, “What’s the seize?” Surprisingly, there is not one. Qualifying for Varo Bank’s high APY is as smooth as 1-2-3. All you need to do is:

a. Set Up Direct Deposits

Ensure you receive direct deposits of at least $1,000 each month into your Varo Bank Account. This steady flow of income helps you unlock Varo Bank’s highest APY tier.

b. Maintain a Positive Balance

Keep your Bank and Savings Accounts inside the green at the top of each month. As long as you maintain high-quality stability, you may continue to revel in the advantages of Varo Bank’s high APY.

Watching Your Savings Grow

Once you’ve met the necessities, sit once more and watch your financial savings flourish. With Varo Bank’s High-Yield Savings Account, you could say goodbye to stagnant financial savings and a good day-to-day economic increase.

Automatic Savings Tools

Are you tired of stressing over saving money? Varo Bank has the solution for you! With our computerized financial savings gear, dealing with your price range has in no way been less complicated. Let’s break down how those pieces of equipment work and how they permit you to attain your economic dreams effortlessly.

Save Your Change

Have you ever questioned what to do with all that spare exchange lying around? Say goodbye to unfastened cash and true day to sizable financial savings with Varo Bank’s “Save Your Change” feature. Here’s the way it works:

- Round as much as shop up: When you make a purchase we automatically round up the transaction to the dollar.

- Build your financial savings: The rounded-up trade is transferred out of your checking account to your Varo savings account.

- Watch your savings develop: Over time, those small contributions upload up, supporting you to assemble a big monetary financial savings stability without even noticing.

Varo clients collectively saved over $295,000,000 in 2022 using our car-savings equipment. Imagine what you can attain with only some cents right here and there!

Save Your Pay

Are you guilty of spending your whole paycheck without putting aside any savings? You’re no longer by myself. Many people battle to prioritize saving cash every month. Varo Banks’ “Save Your Pay” feature is really handy. Let me explain how it works;

- Set it and overlook it: Just turn on the “Save Your Pay” feature. Choose how much of your salary you want to spend on shopping.

- Automate your savings: Once activated, Varo Bank will robotically transfer the required percent of your paycheck immediately into your Varo savings account.

- Achieve your desires quicker: By always saving a portion of your income, you’ll make large progress towards your financial goals with no extra effort.

Varo Banks’ automated savings tools empower you to manage your finances and witness the impact, on your savings. Bid farewell to stress. Welcome a brighter financial future, with Varo Bank. Start saving smarter these days!

Sending Money Made Easy with the Varo Bank

Sending money to buddies, circle of relatives, or every person else has in no way been less difficult with the Varo Bank mobile app. Whether you want to break up an account, pay off a chum, or send cash for any purpose, Varo Bank has you covered with its handy and user-friendly functions.

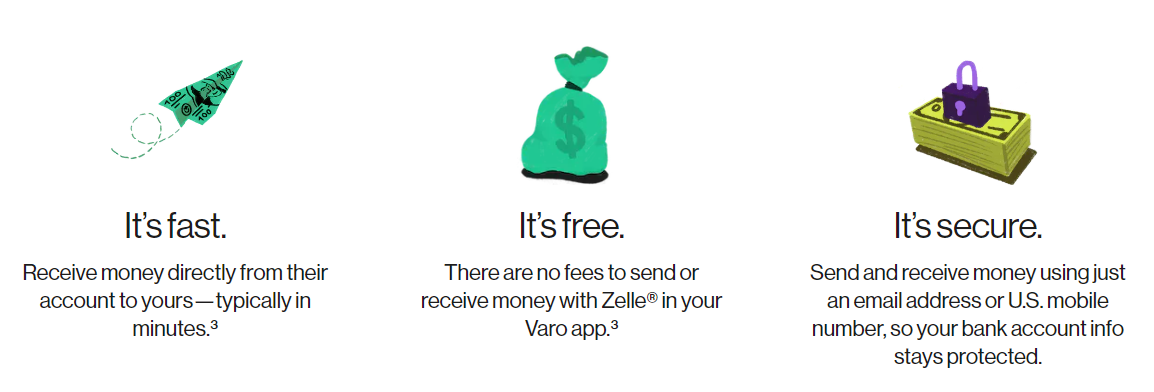

Quick payments with Zelle®

Receive money directly from other people’s accounts to yours in minutes with Zelle® integration right in your Varo Bank mobile app.

Transactions without fees

Enjoy sending and receiving cash without being stressed about any costs. Zelle® transactions inside the Varo Bank mobile app are free.

Secure transactions

With Zelle®, you could ship and acquire cash with the usage of the simplest US email deal with or cell smartphone number, retaining your bank account information secure.

Varo Transfers to Anyone

Instant transfers

Send money instantly to anyone, no matter where they bank, directly from the Varo app. And the best part? It’s completely free.

All-in-One banking

Seamlessly hyperlink all of your financial institution bills in the Varo app so you can without problems pass cash between bills each time you need to.

Sending Money Made Easy with the Varo Bank Mobile App

Tired of dealing with complicated money transfers and high fees? Look no further than the Varo Bank mobile app! With Varo, sending money to anyone, anywhere is as easy as 1-2-3, and the best part? It’s fast, free and secure. Let’s break down how Varo makes sending money a breeze:

Instant transfers

Sending money with Varo is lightning fast! Whether you’re sharing an account with friends or sending love to family, your money will reach its destination instantly.

Transactions without fees

Say goodbye to annoying transaction fees! With Varo, you pay no fees for sending and receiving payments. That means more money in your pocket and less worry.

Top Security

Your safety is the highest priority for Varo. We assure you that your data is protected by advanced encryption, keeping your personal information safe.

How It Works Varo Bank Mobile App

Varo makes sending cash a breeze with its intuitive app interface. Here’s how it works:

Sending Money

- Add your recipient: Simply type in their email or phone number.

- Enter the dollar amount: You can also add a personalized note.

Send! Yup, it’s that easy.

Receiving money

- Enter your information: Enter your debit card information or open a Varo Bank account to receive money.

- Accept payment: Money will be transferred to your account instantly. Nice!

Conclusion

With the Varo Bank mobile app, sending money has never been less difficult and extra convenient. Whether you’re paying bills, overlaying charges, or sending gifts, Varo’s speedy, loose, and secure platform has you included. Say goodbye to prices and hi there to problem-free cash transfers with Varo Bank. Try it nowadays and enjoy the difference!

FAQs

1. What is the Varo mobile deposit limit?

Turn on push notifications to see when your coins arrive in your account. Tap My Varo > Settings > Transactional Notifications, then toggle the tab to the right to enable transactional notifications. *You can make a maximum deposit of $5,000 each month.

2. How do I deposit a large check with Varo?

Simple Process: Depositing a take a look at Varo Check Deposit is an honest technique. Users certainly want to suggest the return of the test, take a clear photograph of the back and front of the check using their cellular tool’s digital camera, and post it through the mobile app.

3. Does Varo have mobile check cashing?

Follow the stairs within the app to take pictures of the front and back of the take a look at. If everything seems desirable, faucet Submit test. You’ll obtain an e-mail confirming we’re beginning our evaluation system. Once authorized, you will obtain an email along with your Deposit Check Availability.