The Zarai Taraqiati Bank App is a surely cool cellular banking app that makes banking fantastic smooth and fast. It has a simple design and strong protection to hold your money safe. With this app, you could do such things as test your account, ship money, pay payments, and use plenty of different banking offerings right out of your phone. Whether you’re busy or just want banking to be clean, this app is ideal for you. In this weblog publish, we’ll communicate about what makes this app unique and how it may make your banking lifestyles simpler.

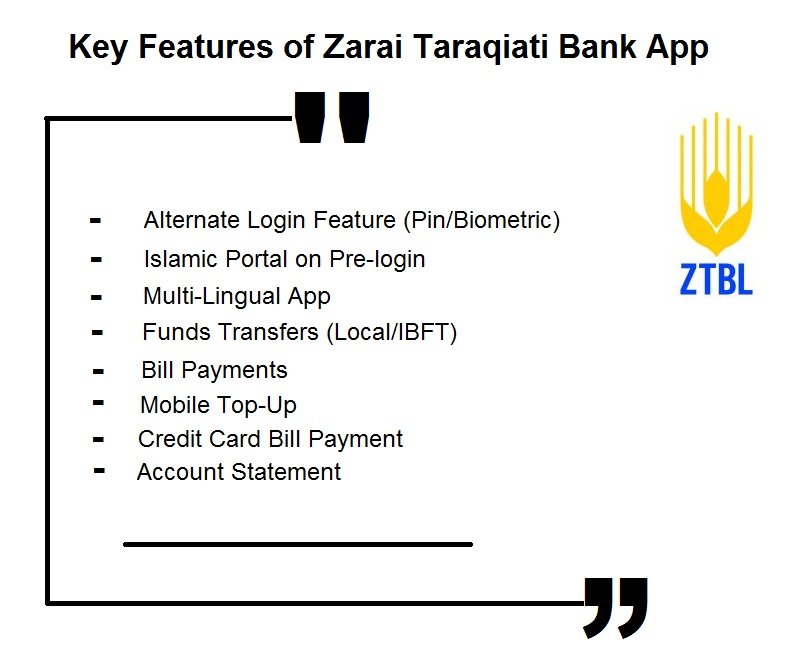

Key Features of Zarai Taraqiati Bank App

1. Alternate login feature (Pin/Biometric):

- People can get into the app using either a PIN or their fingerprint or face.

- This makes it safer and easier because they can choose the way they like to log in.

2. Islamic Portal on Pre-login:

- Quran and Tashbeeh: Users can study and recite the Quran and get the right of entry to supplications for various events.

- Prayer times and schedules: Users can view prayer instances and schedules for his or her vicinity.

3. Multi-Lingual App:

- The app helps more than one language, making it accessible to a various consumer base.

- Users can pick out their favored language for the app interface and content material.

4. Funds Transfers (Local/IBFT):

- Users can transfer funds within ZTBL accounts (local transfers) or to other banks through Inter-Bank Funds Transfer (IBFT).

- This feature allows for easy and convenient fund transfers.

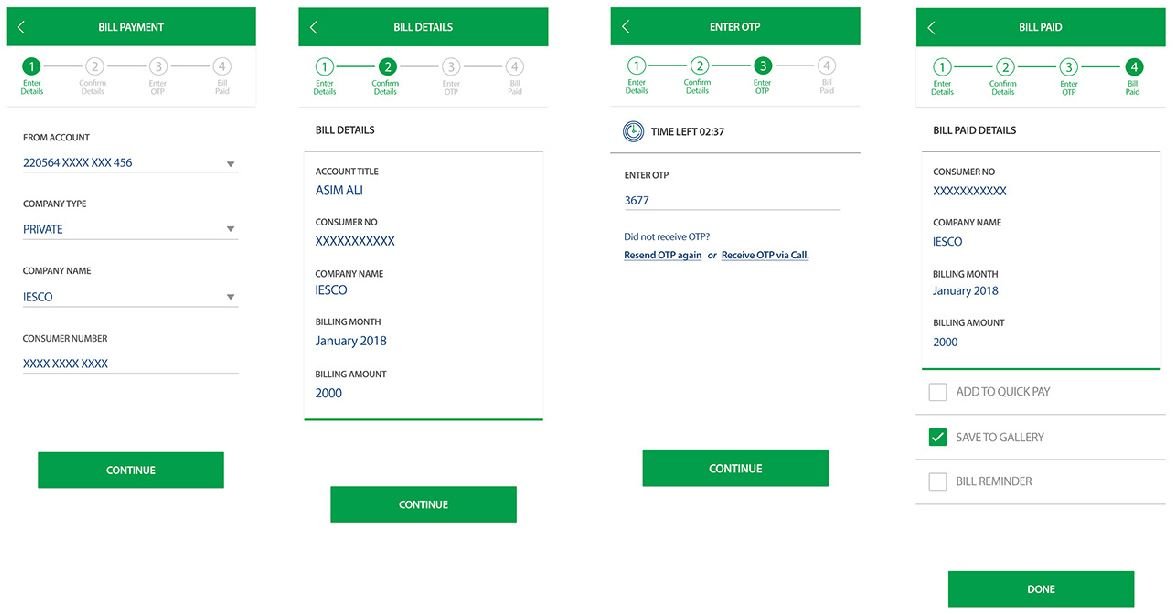

5. Bill Payments:

- Users pay numerous payments, along with software bills (e.g., strength, fuel, water), credit card bills, and other bills.

- This feature simplifies bill payment techniques and facilitates users to stay on the pinnacle in their monetary duties.

6. Mobile Top-Up:

- Users can recharge their mobile phone balances directly through the app.

- This feature is convenient for users who need to top up their mobile phones quickly and easily.

7. Credit Card bill payment of other banks through the 1BILL feature:

- Users can pay credit card bills from other banks using the 1BILL feature.

- This feature provides a convenient and centralized way to manage credit card payments.

8. Account Statement:

- Users can view detailed account statements and transaction history.

- This feature helps users keep track of their financial activities and stay informed about their account balances and transactions.

Must Read: Askari Bank Mobile App

User Guide

Downloading the App

- Open the App Store or Google Play Store: Look for the App Store when you have an iPhone or Google Play Store when you have an Android cellphone. These are where you get new apps.

- Search for the Zarai Taraqiati Bank App: Use the search bar and sort “Zarai Taraqiati Bank App“. When you spot the app, the tap is on it.

- Download the App: Tap the button that broadcasts “Get” (for iPhones) or “Install” (for Android telephones) to start getting the app.

- Wait for it to Download: The app takes some time to download and install on your cellphone. Just wait a bit.

- Launch the App: When it’s achieved, you may see an “Open” button. Tap that to start using the app.

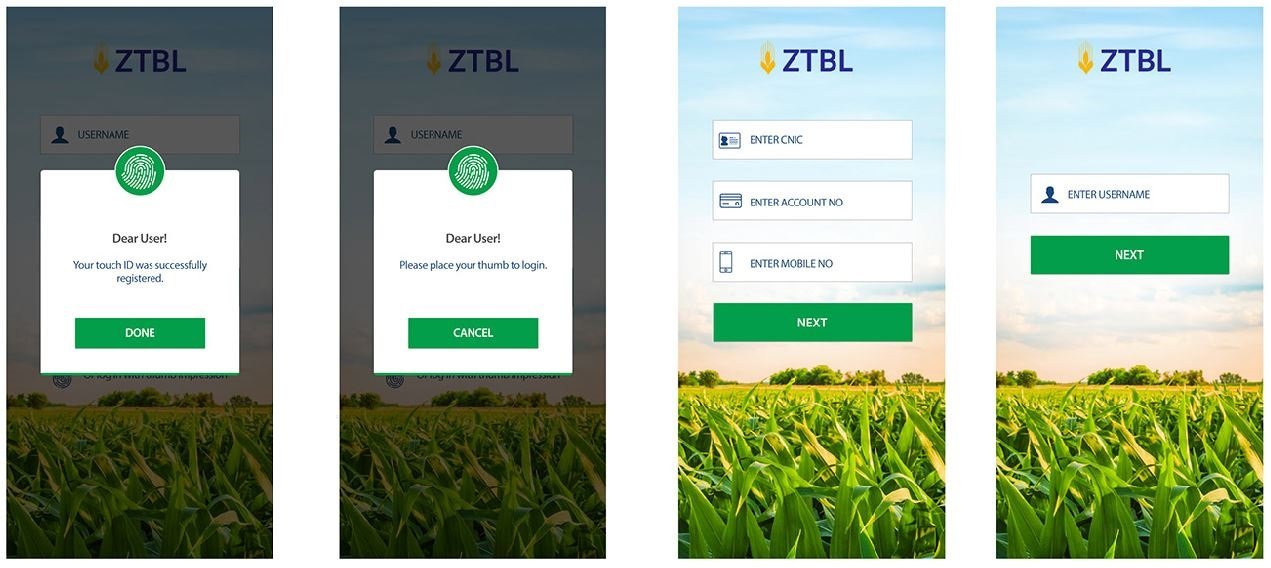

Registering for the Zarai Taraqiati Bank App

- Sign Up: When you open the app, faucet on the “Sign Up” button.

- Account Number: Type for your Zarai Taraqiati Bank account range.

- CNIC Number: Enter your CNIC (Computerized National Identity Card) wide variety.

- Phone Number: Put on your cellphone range that you registered with.

- Create Username and Password: Choose a unique username and password for the app.

- Confirm Password: Type your password over again to make certain it’s right.

- Complete Registration: Tap the “Submit” button to complete signing up.

Logging in to the App

- Launch the App: Open the Zarai Taraqiati Bank App on your device.

- Enter Username: Enter your registered username.

- Enter Password: Enter your password.

- Sign in: To open the application, tap the “Login” button.

- OTP Verification: If precipitated, enter the OTP (One-Time Password) despatched in your registered smartphone’s massive variety.

If you forget your password, tap the “Forgot Password” button and observe the commands to reset your password.

Navigation and Interface

The interface is designed to be consumer-friendly, with clean and concise labels, clean-to-use menus, and outstanding buttons for key capabilities. The app additionally carries robust security measures, which include encryption and -aspect authentication, to defend user information and prevent unauthorized get entry.

Here is a detailed note on the interface of the Zarai Taraqiati Bank App:

Login Screen

- Username and Password fields

- Login button

- Forgot Password link

- Register button (for new users)

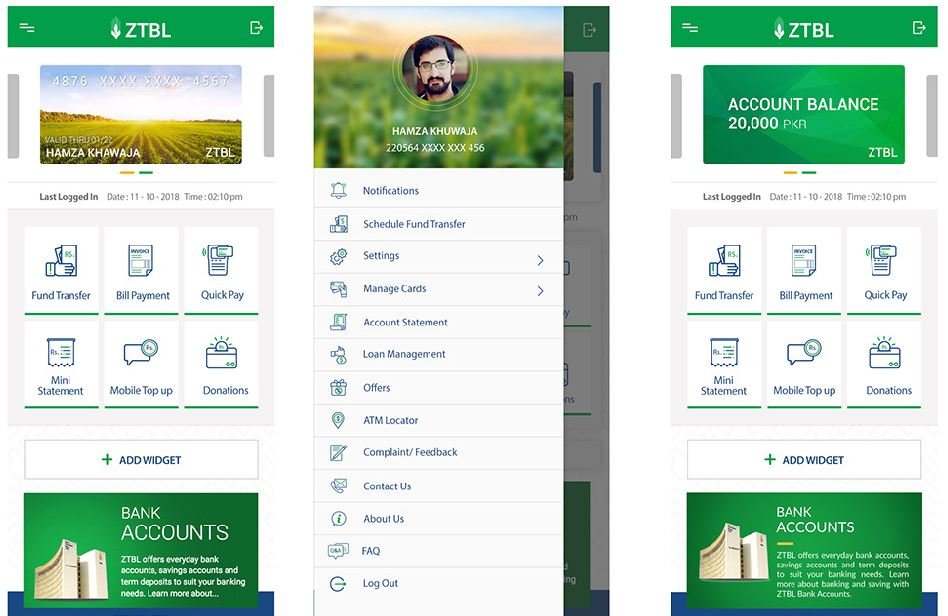

Dashboard

- A welcome message with the username

- Account overview (account balance, last login, etc.)

- Quick links to frequently used features (e.g., fund transfer, bill payment)

- Notification center (for alerts and messages)

Account Management

- Account list (with account numbers, balances, and types)

- Account details (account history, transactions, etc.)

- Fund transfer (between accounts or to other banks)

- Account settings (edit account information, change password, etc.)

Loan and Credit Services

- Loan application (personal, car, home, etc.)

- Loan status (application status, repayment schedule, etc.)

- Credit card management (balance, payment due, etc.)

Deposit and Investment

- Deposit account management (fixed deposit, savings, etc.)

- Investment products (term deposits, pension plans, etc.)

- Investment returns and statements

Bill Payment and Utilities

- Bill payment (electricity, gas, water, etc.)

- Utility services (mobile recharge, internet, etc.)

Customer Support

- Contact us (phone, email, chat)

- FAQs (frequently asked questions)

- Branch and ATM locator

Settings

- Change password

- Enable/disable biometric login (fingerprint or face recognition)

- Customize notification preferences

- View the app version and terms and conditions

Account Management

Managing your accounts is easy with the Zarai Taraqiati Bank App. Here’s how:

- View Balances: Check your account balances in actual time.

- Transaction History: View current transactions, along with deposits, withdrawals, and transfers.

- Fund Transfer: Transfer the budget among your accounts or to different financial institution bills.

Here is a detailed, step-through-step manual on Account Management in the Zarai Taraqiati Bank App:

Account List

- Log in to the Zarai Taraqiati Bank App

- The “Accounts” tab at the bottom of the screen should be tapped.

- View your account list, which includes:

-

- Account number

- Account type (e.g., savings, current, etc.)

- Account balance

- Last transaction date

- Tap on an account to view more details

Account Details

- Tap on an account from the account list

- View account details, including:

-

- Account history (transactions)

- Account balance

- Available balance

- Overdraft limit (if applicable)

- Interest rate (if applicable)

- To see more information, tap on a transaction.

Fund Transfer

- Press the “Transfer” button located at the lower part of the screen.

- Choose the account from which you wish to move funds.

- Select the account you want to transfer to (or enter a new account number)

- Enter the transfer amount

- Confirm the transfer details

- Tap “Transfer” to complete the transaction

Account Settings

- Tap on the “Settings” icon (gear or three dots) next to an account

- Edit account information:

-

- Account name

- Account nickname

- Account type

- Change account password

- Set up account alerts (e.g., low balance, large transactions)

- Tap “Save” to save changes

Account Closure

- Tap on the “Settings” icon (gear or three dots) next to an account

- Scroll down and tap “Close Account“

- Confirm Account closure

- Tap “Close” to complete the process

Note: Please note that account closure may have implications, such as affecting linked services or pending transactions. For assistance, kindly contact customer support.

Also Read: Meezan Bank Mobile App: Complete User Guide

Transactions

- Log in to the Zarai Taraqiati Bank App

- Tap on the “Accounts” tab

- Decide the account to do the transaction from.

- Tap on “Transfer” or “Pay Bill” relying on the transaction type

- Enter the transaction details (e.g., recipient’s account quantity, amount, and so forth).

- Confirm the transaction details

- Tap “Transfer” or “Pay” to complete the transaction

Reset Password

- Tap on the “Forgot Password” button on the login screen

- Enter the email address or phone number you have on file.

- Tap “Submit“

- Get a code or link to reset your password via SMS or email.

- Follow the instructions to reset your password

- Create a new password and confirm it

- Open the app and sign in using your new password.

Loan and Credit Services

- Log in to the Zarai Taraqiati Bank App

- Tap on the “Loans” tab at the bottom of the screen

- View available loan and credit services:

-

- Personal Loan

- Car Loan

- Home Loan

- Credit Card

- Tap on a loan or credit service to view more details

Application of Loan

- Tap on the “Apply Now” button for the desired loan or credit service

- Fill out the loan application form:

-

- Personal information (name, address, etc.)

- Employment information (income, job title, etc.)

- Loan amount and tenure

- Upload required documents (ID, income proof, etc.)

- Review and submit the application

Loan Status

- Tap on the “Loan Status” tab

- View the status of your loan application:

-

- Pending

- Approved

- Rejected

- Disbursed

- View loan details:

-

- Loan amount

- Interest rate

- Tenure

- EMI (Equated Monthly Installment)

Credit Card Management

- Tap on the “Credit Card” tab

- View credit card details:

-

- Card number

- Expiry date

- Available limit

- Outstanding balance

- Make payments:

-

- Pay minimum due

- Pay full amount

- Set up auto-pay

- View transaction history

Benefits

- Competitive interest rates

- Flexible repayment tenures

- Quick approval and disbursal

- Easy EMI options

- Credit card rewards and benefits

Note: Please note that loan and credit services are subject to eligibility criteria and approval by the bank. Interest rates and terms may vary. Please contact customer support for assistance.

Deposits and Investments

Deposits

- Log in to the Zarai Taraqiati Bank App

- Tap at the “Deposits” tab at the lowest of the display

- View available deposit options:

-

- Fixed Deposit (FD)

- Savings Account

- Current Account

- Tap on a deposit option to view more details

Fixed Deposit (FD)

- Tap on the “Fixed Deposit” option

- Select the deposit amount and tenure (duration)

- Choose the interest payout frequency (monthly, quarterly, etc.)

- Confirm the deposit details

- Tap “Deposit” to complete the transaction

Savings Account

- Tap on the “Savings Account” option

- View your savings account details:

-

- Account balance

- Interest rate

- Transaction history

- Tap “Deposit” to add funds to your savings account

Current Account

- Tap on the “Current Account” option

- View your current account details:

-

- Account balance

- Transaction history

- Tap “Deposit” to add a budget for your modern-day account

Investments

- Tap on the “Investments” tab at the lowest of the display

- View available investment options:

-

- Term Deposit

- Pension Plan

- Investment Funds

- Tap on an investment option to view more details

Term Deposit

- Tap on the “Term Deposit” option

- Select the investment amount and tenure (duration)

- Choose the interest payout frequency (monthly, quarterly, etc.)

- Confirm the investment details

- Tap “Invest” to complete the transaction

Pension Plan

- Tap on the “Pension Plan” option

- Select the investment amount and tenure (duration)

- Choose the pension payout frequency (monthly, quarterly, etc.)

- Confirm the investment details

- Tap “Invest” to complete the transaction

Investment Funds

- Tap on the “Investment Funds” choice

- Select the funding amount and fund kind (e.g., fairness, debt, and so forth.)

- Confirm the investment details

- Tap “Invest” to complete the transaction

Benefits

- Competitive interest rates

- Flexible tenure options

- Easy investment process

- Professional investment management

- Tax benefits (where applicable)

Note: Deposits and investments are problems to phrases and situations, and interest rates may also vary. Please do not hesitate to contact customer care if you require assistance.

Bill Payment and Utilities

Pay your bills and utility bills with ease:

Bill Payment

- Log in to the Zarai Taraqiati Bank App

- Tap at the “Bill Payment” tab at the lowest of the display

- Select the biller category (e.g., energy, gas, water, and so on.)

- Choose the biller name (e.g., K-Electric, SSGC, and so on.)

- Enter your account number or consumer number

- Select the payment amount

- Choose the price technique (e.g., debit card, credit card, and many others.)

- Confirm the payment details

- Tap “Pay” to complete the transaction

Available Billers

- Electricity (e.g., K-Electric, LESCO, and many others.)

- Gas (e.g., SSGC, SNGPL, and many others.)

- Water (e.g., KWSB, etc.)

- Internet (e.g., PTCL, etc.)

- Mobile (e.g., Jazz, Telenor, etc.)

- Landline (e.g., PTCL, and so on.)

- Insurance (e.g., existence coverage, car coverage, and masses of others.)

- Loan bills (e.g., non-public mortgage, vehicle mortgage, and so on.)

Payment Methods

- Debit Card

- Credit Card

- Net Banking

- Wallet (e.g., JazzCash, Easypaisa, etc.)

Benefits

- Easy and convenient bill payment

- Avoid late payment charges

- Receive instant confirmation

- View payment history

- Schedule payments in advance

Tap on “Note: Please recollect that the way you pay bills could probably exchange depending on where you are and what companies you’re paying. Also, make certain you have enough cash for your account to finish the price.

Customer Support

We’re right here to assist! If you have any questions or problems, contact our customer service crew:

- Contact Us: Call, electronic mail, or chat with our customer support group.

- FAQs: Find solutions to regularly asked questions and troubleshooting pointers.

Security and Privacy

Your safety and privateness are our top priority:

- Secure Login: Log in securely together with your username and password.

- Data Protection: We defend your personal and financial facts with strong security measures.

Conclusion

The Zarai Taraqiati Bank App is designed to make banking less difficult and more handy. With this complete customer manual, you are now prepared to navigate the app with self-perception. Remember, when you have any questions or want help, our customer service crew is continuously right here to assist.

FAQs

1. What is the purpose of Zarai Taraqiati Bank?

Dedicated to serving the needs of the farming network, delivering financial products and technical offerings on a competitive and sustainable basis, in a handy, efficient, and professional way, leading to the achievement of the Bank and the farmers.

2. What questions should I ask about Islamic banking?

Islamic Banking FAQs. What is the distinction between Conventional banking and Islamic banking? Is the prohibition of Riba practice equal to the loan acquired from or extended to a Muslim in addition to a Non-Muslim? Is Interest / Riba associated most effective to intake loans or does it also apply to commercial loans?

3. How does Islamic Bank reward their depositors?

In an Islamic financial institution, the cash supplied in the form of deposits isn’t always loaned, however is alternatively channelled into an underlying investment activity, a good way to earn income. The depositor is rewarded through a proportion of that profit after a management price is deducted using the financial institution.

4. How to calculate interest rate?

To calculate hobby quotes, use the formula: Interest = Principal × Rate × Tenure. This equation enables decide the hobby rate on investments or loans. What are the advantages of the use of a mortgage interest fee calculator? A mortgage interest fee calculator gives several benefits.

5. Which bank is growing?

HDFC Bank saw the very best mortgage growth of 55.4 consistent with cent on-year thanks to the merger of erstwhile HDFC with HDFC Bank effective July 2023. Sequentially, credit growth becomes 1.6 in step with a cent higher. The bank’s deposits rose 26.4 according to cent in 12 months and seven.5 in step with cent in the area.